Unpacking The Private Equity Control Problem

Working in private equity is not for the faint-hearted. Deal teams are constantly in motion, instructing the work needed to push transactions forward. At the same time, legal and finance teams are expected to closely manage costs and stay within budget.

This creates a control problem.❌

Deal teams direct law firms to take action but rarely consider larger budget implications. Meanwhile, internal legal and finance teams lack visibility day-to-day across multiple firms. So how can private equity firms take back control and reign in legal spend effectively?

In this blog, we'll unpack the underlying issues that exacerbate private equity's control problem, drawing insights from real legal, deal, and finance team members. Plus, we'll point to solutions that can connect the dots between law firm instructions, legal budget oversight, and accurate financial planning.

Let’s get into it.

The challenge for PE legal teams

For General Counsels and senior legal executives, managing outside counsel spend can feel like an impossible task. They're expected to maintain firm oversight of legal budgets, yet lack the tools and visibility to do so effectively.

The main problem? Getting a clear picture of real-time spending across multiple law firms and high volumes of investment matters is extremely difficult in private equity.

Legal professionals often tell us they have a good sense of scope for any individual matter, but lack clarity on overall spending behavior across some 30+ law firms. This leaves unpleasant surprises, far too often.

The data illustrates this point clearly. Our research found that 76% of legal teams believe investment matters frequently exceed expected costs set at the outset. And without live transparency into accrued fees, GCs remain in the dark as external legal spending escalates across a portfolio of deals.

This data reveals a staggering trend - the majority of investment matters end up going over-budget, and the overages aren't trivial. Cumulatively, these "small" cost overruns become major budget excesses.

In fact, excessive legal fees can accumulate rapidly even in routine fundraising processes. Think about it. With hundreds of investor interactions in a fundraising, the legal counsel costs for agreeing to such terms can easily get out of proportion.

For time-strapped GCs overseeing complex portfolios of high-value investments, regaining control seems daunting. How can they rein in widespread overspending when they can't see day-to-day legal spend activity, until after the fact?

The challenge for PE deal teams

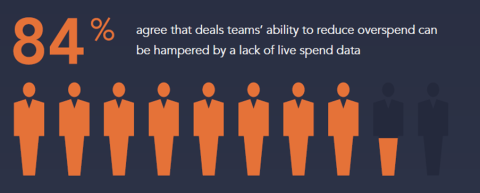

For private equity professionals driving transactions, legal spend overruns can quickly escalate, putting budgets and deadlines at risk. Our research found that 84% of deal teams admit they struggle to control legal costs in the heat of fast-paced deals.

Bill Priestley, a Director at Epiris, explains the intense pressure deal teams face:

“The law firm would always give you a breakdown of how they spend their month, but there would be very little ability to manage in real-time how costs were being incurred. It’s like you’re seeing the tip of the iceberg.”

As Priestley suggests, without live spend data to reference, deal teams often realize cost overruns too late. And in the rush to meet transaction timelines, they rarely have the option to pause activity that could control mounting legal fees.

It’s a bit like a runaway train - once in motion, seemingly trivial matter-by-matter overages gain momentum, carrying aggregate legal spend far beyond initial expectations. Our research discovered this is a widespread phenomenon:

As this data shows, the majority of deals end up exceeding budget targets, and by non-trivial amounts, often adding up to 10-20% above forecast.

But perhaps most troubling for deal teams is the inability to course correct when budget overages do surface. By the time the law firm provides detailed invoices weeks later, there’s often no way to fix overspend retroactively or change approaches. You just ended up justifying surprises to the investment committee afterwards.

The ultimate result of this spend visibility gap? Deal teams lose critical budget control and influence over legal costs during the most intense period of transaction activity.

The challenge for PE finance teams

For private equity finance leaders, unpredictable legal spend makes budgeting and forecasting hugely frustrating. The problem stems from the lack of real-time visibility into accrued legal fees ahead of receiving invoices.

Because law firm bills typically arrive 60-90 days post-work, finance teams often rely on guesswork to estimate monthly legal expenses.

Finance teams often share the difficulties this causes. They might estimate £100K will hit the books for legal in a month. But when invoices turn up months later, they find themselves off by 30-50%. These swings make understanding run-rate legal spend almost impossible.

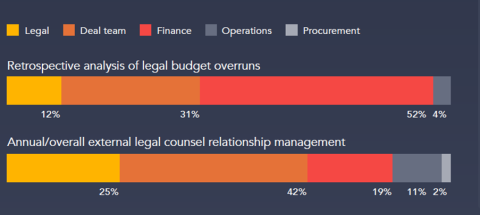

Such large variances result in constant budget shortfalls, forcing finance to source contingency funds. But the unpredictability also creates friction cross-departmentally. In fact, 78% of legal teams report unexpected cost overruns from external counsel place strain between themselves and finance colleagues. The majority of legal teams believe retrospective analysis should sit with finance.

Part of this dynamic involves disagreement over who owns responsibility when budgets are exceeded. Finance leaders expect their team to manage costs better once invoices reveal surprises. But without live visibility ahead, they can only tackle problems in hindsight.

This confusion over accountability for legal overspend drives frustration and implies legal teams mismanage budgets intentionally - which is rarely the reality.

The solution lies in giving both finance, deal and legal teams real-time visibility into accrued legal spend from external counsel ahead of invoices arriving. Armed with clearer insight, both teams can work collaboratively to curb overspend issues before they become painful budget variances.

The solution to align private equity teams

With legal, deal, and finance teams all facing challenges controlling external counsel spend, the solution is clear: Real-time visibility into legal spend across the firm.

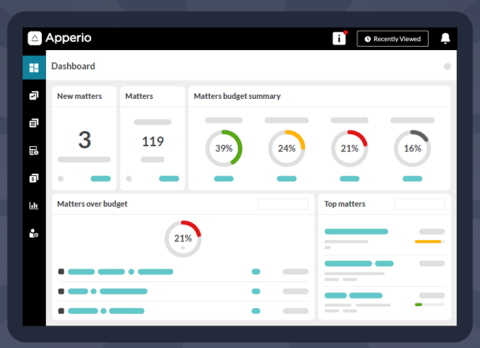

By aggregating live data from law firms' time and billing systems, legal spend management software, like Aperrio, gives private equity professionals transparency into accrued fees before the invoice arrives.

Armed with granular visibility, here's the impact this level of insight provides:

💼Legal teams: Spend management software puts General Counsels back in the driver's seat of legal budgets, even overseeing complex global portfolios. By consolidating live fee data across law firms, matters, and jurisdictions, GCs can spot overspend risks early and curb excessive costs. They can advise deal teams strategically without needing to micromanage daily legal activity.

🤝Deal Teams: With legal spend analytics to reference, PE professionals can course correct on budgets during deals vs. explaining surprises afterwards. By linking firm-wide visibility to matter-level decision making authority, they balance oversight with autonomy based on up-to-date data.

💰Finance Teams: Accrued fee data visibility ahead of the invoice allows for accurate monthly forecasting of legal spend, instead of risky estimates. With legal teams armed with the same spend insights, friction around overages can shift to collaboration on efficiency.

Bottom line: Consolidating real-time legal spend visibility across firms not only solves the control problem - it represents a new best practice. Unifying legal, deal, and finance leaders around live data ensures tight budget management no longer comes at the expense of business velocity.

If you are ready to get everyone on the same page, ensuring legal, finance and deal teams work off the same information, in real-time, we invite you to book a demo.