6 tips to unleash the power of visualizing legal spend and WIP/accruals

Companies relying on external legal counsel faced escalating costs, as The Am Law 100 firms set a new benchmark for rate increases in 2023. The average hourly rates charged by these top law firms rose by a staggering 7.3%, reflecting the highest rate of growth in recent years.

At the same time, General Counsel feels intensifying pressure to minimize costs through a tighter grip on expenses. This places legal spend management firmly in the spotlight.

General Counsel and legal operations professionals recognize that every dollar trimmed from legal spend has a direct impact on bottom-line returns. However, realizing savings is easier said than done without comprehensive visibility into all legal and external advisor spend:

- Where is the money being spent?

- Which internal teams or external law firms accumulate the highest costs?

- What areas of spending are growing fastest?

- How can I use data and benchmarks to get the best value?

Without clear answers, firms struggle to implement targeted cost-control initiatives.

Enter: legal spend analytics dashboards. This approach allows firms real-time cost tracking and more accurate future spend forecasts. Turning real-time billing data into actionable insights through relevant KPIs and visualizations delivers this required transparency into accrued fees, WIP, expenses, and opportunities for improvement.

This blog explores practical techniques to visualize and efficiently manage legal spend. It emphasizes how technology is given a much-needed upgrade to traditional approaches. 👇

Quick overview: What is legal spend visualization

Legal spend visualization is when time and billing data is processed and presented through graphs, charts and dashboards to make it easier to interpret and understand legal expenses. It's a critical part of effective legal spend management as it enables stakeholders—from legal operations, GC’s, and finance teams to top management—to instantly gain a view of where and how their money is being spent on legal services.

By visualizing legal spend and automating flags, it makes it easier to spot trends, pinpoint inefficiencies, and uncover opportunities for cost-saving that would be difficult to spot in traditional spreadsheets or reports.

But there’s more. Visualization goes beyond mere tracking of spend. It provides an interactive way to analyze data that supports strategic decision-making—thanks to features like real-time tracking, comparing costs against budgets or historical data, and forecasting future spend based on current trends.

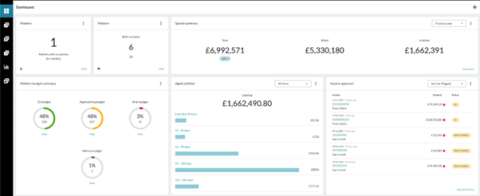

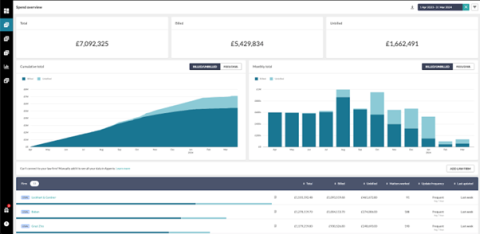

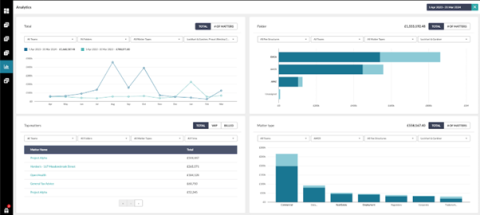

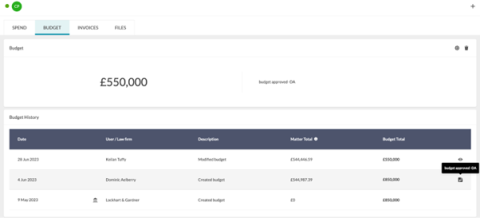

[Example legal spend visualization from Apperio]

The importance of visualizing legal spend

With the power to anticipate and plan for legal spend, companies can transform these expenses from a burden that often feels uncontrollable to a strategic investment that creates value.

We’ve briefly touched on some of this in the introduction, but let’s cover this in more detail:

✅Total cost clarity: Dashboards and data visualizations including real-time WIP/accruals offer instant insights into the total spend liability and expenditure of legal and external professional service costs. This level of clarity improves understanding and facilitates effective monitoring.

✅Identification of patterns and trends: Delving into legal spend data uncovers recurring patterns and trends, enhancing the accuracy of predictions and future strategic planning.

✅Data-driven decisions: Armed with comprehensive analytics and visualizations, decisions regarding legal spend are informed by concrete data insights, enhancing precision and strategic impact.

✅Accurate budget forecasting: Utilizing analytics and identified trends, the crafting of future legal budgets becomes markedly more accurate, enabling better planning and allocation of resources.

✅Optimization of resources: Detailed visibility into resource utilization highlights areas of excess or deficiency, allowing for informed reallocation and optimization for maximum value.

✅Risk detection: Anomalies or spikes in legal spending can signal potential risks, such as litigation exposure, prompting timely and proactive mitigation actions.

✅Identification of cost control opportunities: In-depth spend analysis reveals specific opportunities for reducing unnecessary expenditure, targeting areas for cost-saving measures.

✅Strategic alignment: Analytics-driven insights ensure legal spending decisions are aligned with the broader business strategy and objectives, focusing on achieving optimal value beyond mere cost savings.

This way, legal becomes an asset for enabling intelligent growth, pursuing new opportunities, and sustaining a long-term edge—one insight at a time.

Sounds intriguing? Let’s now look at what this looks like practically, with real screenshots of legal spend visualization in action.

6 tips to visualize legal spend

Legal spend visualizations are more than a nice-to-have tool. They’re essential to bringing legal spend management into the modern age for better decision-making.

Here are 6 top tips to consider:

1. Embrace digital transformation 📲

Cutting-edge legal spend management software delivers real-time visibility into all costs—as they occur. These tools transform raw data into actionable insights that are easily accessible via intuitive dashboards and graphs. So, at a glance, firms gain clarity into exactly where funds are being used across matters, projects, and legal subdivisions.

Solutions like Apperio, consolidate legal spend in one place. So there’s no need to wait for monthly invoices or siloed department reports. Plus, all costs can be monitored seamlessly from a centralized hub, in line with budget thresholds.

The result? This transparency enables proactive mitigation of overruns, before they even hit the books. Rather than retrospective analysis, firms can pivot to predictive planning and decision-making around legal spend.

2. Set data-driven goals and benchmarks 📊

Using benchmarks helps companies evolve from looking at past legal spending to guiding future spending in a smarter way. Benchmarks provide targets for legal costs based on previous years' data and industry standards. Comparing current legal spending to benchmarks shows where a company is overspending or doing better than peers.

Tools like Apperio compare a company's legal expenditures to past spending and other companies of similar size and industry. This helps put their legal costs into perspective.

With benchmarks as guideposts, managing legal spend becomes an ongoing journey rather than a static one-time task. Goals transform into evolving milestones for optimizing spending over time. Every legal expense brings the company closer to defined targets or signals an adjustment is required.

The result? Solid financial goals combined with data-driven benchmarks steer companies toward advanced strategic priorities. The path forward relies on a blend of internal data patterns and external industry standards. All of this means legal spend management becomes more navigable rather than flying blind.

3. Leverage data to plan future legal costs🔮

The right software can now forecast future legal spending by finding patterns in past data. By studying how much money was spent on legal in prior years, the software makes predictions about how much will be spent next year.

For example, Apperio's software looks at 3+ years of legal and professional services cost data down to phase and task level—to spot trends. For example, it can highlight that real estate spend in a certain region is increasing above expectations, trending higher for the next year, allowing you to take action.

Plus, it can predict if next year's real estate plans will drive higher legal expenses. And with future visibility, companies can better budget and prepare funds just for expected legal costs.

The result? Data predicts how much legal will cost based on activities planned for the upcoming year. This transforms legal spend management from guessing to planning. Companies shift from reacting to legal invoices to predicting optimal resources needed ahead of time.

4. Open communication and collaboration around legal costs 🤲

Clear communication and collaboration between finance leaders, legal teams, and law firms are key to controlling legal expenses. While it may be easier said than done, there are ways to simplify this.

For example, the CFO, General Counsel, and outside lawyers should meet regularly to discuss legal spending—aided by the data visualizations we’ve mentioned above. These meetings allow them to review work whilst it is taking place (WIP and accruals). Allowing this collaboration enabled teams to be proactive, avoiding challenging conversations after the work was completed. It’s a real-time, live, partnership approach to managing costs.

With visual aids, these stakeholders can raise issues early, brainstorm ideas, and find ways to optimize. For example, if the legal budget is off track or certain cases are unusually expensive, they can strategize fixes quickly.

The result? Collaborative discussions centered on real-time visual aids facilitate data-driven, smarter decisions. Because when legal, finance and firms work closely together with shared financial goals, managing complexity becomes easier.

5. Leverage pre-invoice cost tracking 💸

Waiting weeks for invoices limits real-time visibility and the ability to be proactive. By monitoring expenses as they occur, rather than waiting for invoiced amounts, firms gain real-time insights into their financial commitments. This proactive approach allows for immediate adjustments, ensuring that spending remains aligned with budgetary constraints, outside counsel policy, and quality metrics like gearing/staffing.

Here’s how:

- Invest in software, like Apperio, that integrates smoothly with your current outside counsel policy and panel frameworks, enabling effortless data collection and analysis. This software should have the functionality to monitor spend in real-time, categorize it accurately, and raise any flags.

- Educate both your legal and financial teams on the critical nature of prompt data recording and its significance in financial planning.

- Create an environment of collaboration with your external advisors to maximize opportunities to discuss and gain value and quality.

- Deal with any potential issues early and constructively – while the work is being done.

The result? This ensures a tighter grip on legal expenditures, improving financial forecasting, and enhancing strategic decision-making.

6. Balance legal compliance and risk with cost visibility 🔐

Many firms, particularly financial services, and private funds, must follow many complex laws and rules. Real-time cost management on WIP/accruals opens up new approaches to compliance and risk.

First, create a proactive process to identify compliance issues efficiently whilst the work is happening. Automate routine checks when possible, rather than doing manual reviews.

Next, work with your law firms or panel to build a visualization approach that helps quick and collaborative decision-making. Tackling any compliance issues whilst the work is taking place not only means the compliance can be dealt with before an invoice is sent, but you can also ensure quality through staffing is appropriate.

It is important to create an environment of collaboration with your firms that the intent is to avoid disputes when it’s too late - when the invoice arrives. Cleaning WIP/accruals means invoices will be compliant and can be processed and paid quicker - a win-win situation.

The key for companies is using technology to comply with the law while controlling costs and ensuring value.

The result? This proactive approach saves money and manages risks that could be even more costly long-term.

Surface the right legal spend insights for sustainable growth

Effectively controlling legal spend is a high priority for all organizations in today's economic environment. The smart use of new legal software, data analysis, and collaboration can save costs and ensure compliance.

Modern tools provide real-time visibility to surface precisely where the money goes, allowing tighter control. Building open communication between finance, legal teams and law firms also enhances alignment around saving costs and managing risk.

With advanced tracking and planning, legal shifts from an unpredictable cost center to a source of strategic advantage. Companies move from reacting to legal invoices to predicting and preparing for cost and compliance proactively.

In plain terms, with the right focus and systems, all firms can master legal spend. This control allows them to fuel growth by freeing up capital while preventing expensive legal costs. By following the practical tips here, firms can transform legal spend into a driver of sustainable success.