How to evolve beyond using spreadsheets to track your legal spend

For years, corporates and private equity firms have leaned on spreadsheets to organize legal spend, in particular accruals and WIP – a manual tedium of copying numbers and updating formulas. But as the approach to managing legal spend and the partnership with external counsel matures, there is a pressing need for innovation.

Firms now realize the viability of transitioning from static spreadsheets to automated software built specifically for legal spend management, and capturing real-time accruals and WIP. This technology migration focuses not just on saving time and effort, but on unlocking smarter financial strategies.

Why? Because purpose-built legal spend tools allow legal professional leaders to gain greater visibility into costs, employ advanced analytics, provide timely insights into the business, and ultimately make more informed decisions. And by embracing these specialized legal software systems, firms can reduce risk, exert more control, and introduce a new level of agility to shape better financial outcomes.

Essentially, the traditional spreadsheet has its place in history – modern tech is the only way to get a handle on legal spend management. This is a pretty bold statement so let’s unpack this. 👇

The limitations of spreadsheets in legal spend management

The reliance on spreadsheets for legal spend management and in particular collecting AIP and accruals, while familiar, comes with its set of limitations that can hugely derail a firm's operational efficiency and strategic insight.

❌Spreadsheets depend on manual input

The foundation of spreadsheets is built on the manual input of data, from typing out numbers to importing figures directly from invoices. This not only demands significant time and effort but also introduces a high potential for errors, such as mistyped figures or incorrect formulas. Without diligent verification, these errors can compound, leading to unreliable spend analysis.

❌Fragmented data sources

Legal spending is often tracked across numerous spreadsheets, designated for individual departments or specific matters. Additionally, law firms might send invoices as separate email attachments. This dispersal of information across various files, emails, and storage devices means there isn't a consolidated, centralized source for financial data. Compiling comprehensive firm-wide financial reports becomes a laborious process of manual data amalgamation.

❌Restricted analytical functionality

Though spreadsheets can perform basic calculations like sum totals and percentages, their capacity for in-depth reporting is somewhat limited. Detailed analyses, such as evaluating spend by matter type, law firm, practice area, or billing rates, necessitate the cumbersome process of setting up and adjusting pivot tables. This method not only requires manual updating of pivot table calculations for current insights but also makes generating data visualizations a challenge without the aid of external plugins.

❌Lack of depth of data

Spreadsheets offer the convenience of swift and straightforward editing, making them excellent for recording basic data. However, they usually handle one-dimensional data and excel more with numbers than with detailed narratives critical for analyzing legal expenditures. Law firms frequently use manual spreadsheets to record accruals or work in progress (WIP), a method that falls short of capturing the depth found in narratives and other valuable data points that a real-time connection would facilitate.

These limitations highlight why firms need more sophisticated and secure methods for managing their legal spend – ones that can offer accuracy, real-time insights, and enhanced data security…

The need for specialized legal spend management solutions

Legal expenses are not only substantial but also complex, encompassing a wide range of services from multiple law firms and often professional service advisors. This complexity demands a solution that goes beyond the basic functionalities of spreadsheets, one that can provide a tailored approach to managing and analyzing legal spend efficiently.

Enter: legal spend management software. Here’s why it’s key:

✅Seamless data integration

Legal spend management software streamlines the process by automatically integrating invoice data from various law firms into a unified database. This automated process reduces the need for manual data entry, minimizing errors and ensuring that financial updates are both timely and accurate. All key financial information is housed within a single, easily accessible system, allowing much more straightforward reporting.

✅Unified cloud-based access

Software brings together legal spend data from different suppliers, matters, and projects into a single, secure cloud-based system, available to the relevant members of the legal and finance teams. This eliminates the inefficiencies of distributing spreadsheets, as teams can access updated WIP and accruals data in real-time from the same platform. It enhances collaboration not only among colleagues but also with your valuable external providers – reducing the need for back-and-forth emails.

✅Enhanced reporting and analytics

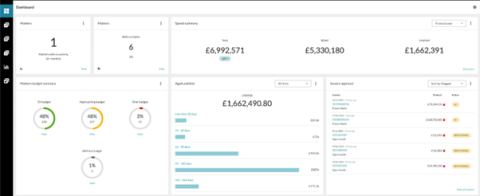

The software offers comprehensive dashboards and various charts, graphs, and reports for an in-depth examination of cost, surpassing the capabilities of traditional spreadsheets. Users can effortlessly monitor expenses by various criteria, such as matter, law firm, practice area, type of work, and business unit. This allows firms to identify unusual spending patterns and opportunities for negotiating better rates – or even reallocating tasks to save costs.

Furthermore, real-time insights into staffing/gearing provide a window into both quality and cost management. For instance, observing an unexpected increase in partner involvement allows for preemptive measures, sidestepping potentially difficult discussions when the invoice arrives.

✅Customizable invoice verification

The software enhances invoice management by setting precise rules for validation, and actively identifying discrepancies or overcharging on law firm bills. It supports rate verification and highlights any deviations from agreed outside counsel policies in both WIP and accruals, extending to the invoice phase. Alerts trigger additional scrutiny before approval, facilitating rate comparisons and benchmarking among various legal service providers.

✅Enhanced budgeting and financial planning

The software comes equipped with advanced tools for enhanced planning, budgeting, and cost management across a matter's lifespan. It provides the finance team and legal operations with a clear view of expected versus actual spending on a per-matter basis – aggregated across projects and portfolios. This enables legal departments to collaborate effectively with finance to refine budgets, presenting a more accurate forecasting approach compared to traditional spreadsheet estimates.

One thing to bear in mind, not all legal spend management solutions are equal. To really benefit from technology, here’s what you need to know…

3 essential features to look for in a legal spend management solution

When evaluating legal spend management solutions, private equity firms should focus on capabilities that enhance visibility, decision-making, and connectivity with existing systems. The top features to prioritize include:

Interactive data visualizations 📊

Look for intuitive dashboards, graphs, and reports that transform raw spend data into actionable insights. The ability to visualize trends, drill into details, spot cost drivers, and identify savings opportunities empowers better and faster decisions around legal spend. Well-designed visuals also spark more productive discussions across teams.

Streamlined invoice processing ➡

Automating the routing, flagging violations, review, approval and payment of legal invoices accelerate workflows while reducing administrative burdens and errors. By systematizing routine tasks and checks, teams minimize duplicated efforts and capture early payment discounts more often. This efficiency improvement also strengthens law firm relationships.

Automated collection of accruals and WIP ⚙

A legal spend management solution should easily connect with your firm's practice management system. This integration ensures that you can capture real-time accruals and WIP data, eliminating the need for manual data entry and emailing of spreadsheets. This not only guarantees consistency, accuracy, and security but also enables a proactive approach to managing violations and law firm relationships. It also simplifies the reconciliation process and enhances overall financial reporting accuracy.

To sum up: The right legal spend management system feels less like a separate software application and more like an intuitive extension of a firm's financial stack. With the right integration and data visualizations, it enriches rather than disrupts existing workflows.

Step-by-step guide to making the switch

Making the move from spreadsheets may seem daunting. It’s what you’ve always known. But, it doesn’t have to feel like a big move. Here are some steps to simplify making the switch to better legal spend management.

Step 1: Define must-haves

Start by aligning stakeholders on main pain points and critical solution requirements. Common needs include better accruals and WIP data visibility, workflow efficiency, analytics, and integration with existing platforms.

Step 2: Narrow down top contenders

Research leading options, like Apperio, that align with your list. Watch demos to visualize the systems firsthand. Evaluate business process fit, value, ease of use, flexibility, and vendor services too. And develop a comparison chart of viable choices.

Step 3: Prioritize capabilities

Catalog and rank product capabilities against your defined requirements. Look for advanced but intuitive technologies that feel like a natural fit versus disrupting workflows.

Step 4: Phase rollout

Once selected, gradually deploy the system across teams, perhaps by department stages. Take lessons from each phase to optimize wider adoption.

Step 5: Emphasize adoption

Make adoption smooth via training and readily available support resources. Gather user feedback for fine-tuning. And quickly address concerns before you experience resistance.

Keen to get started with leading legal spend management software? Here’s why Apperio is a top choice for corporates and private equity firms. 👇

Choose top-performing legal spend management software

Corporates and private equity firms turn to Apperio for advanced legal spend management because it drives transparency, productivity, and a data-backed strategy:

- Real-time WIP and accrual visibility - Apperio's unique direct connection to the practice management system equips users with dashboards that provide real-time legal expense tracking, facilitating well-informed decisions through instant access to financial data.

- Lean workflows - Automatic invoice processing minimizes manual tasks while enhancing accuracy through rule-based validation.

- Insights at scale - Embedded analytics reveal spend patterns and savings opportunities, powering smarter negotiation and budgeting.

- Tight budgetary control - Real-time tracking against dynamic budgets empowers firms to course correct spending promptly.

- Cross-team alignment - Centralized data and reports foster collaboration between finance, legal, and business units.

- Safeguard against overages - Reviewing WIP/Accruals in real time with rich data means you can always see your financial liability. Say goodbye to surprises..

- Sharpen market edge - Process efficiency, analytical acumen in legal spend, and lower costs compound competitive advantage.

With strengths spanning insights, productivity, and strategic enablement, Apperio unlocks new potential for private equity firms to truly gain control and confidence over legal spend.

Ready to see how Apperio would work for you? Book a demo today and our specialists will talk through how it can solve your exact needs.