The CFO’s playbook on legal e-billing: How to make legal spend predictable

Most business functions have nailed financial discipline. Marketing teams plan weekly spend. Operations track every committed cost. FP&A expects near real-time accuracy—line by line.

Yet, oddly, legal remains the exception.

Even in the most mature organizations, legal spend is often:

- Tracked outside standard financial systems

- Managed manually, with little visibility during the matter

- Forecasted late—or not at all

- Audited retroactively, with limited supporting data

For CFOs, that’s a problem. Legal may be a smaller cost center, but it’s one of the least predictable—and one of the most exposed when things go wrong.

In this playbook, you’ll learn how to:

✅ Bring legal spend into line with financial reporting standards

✅ Spot disconnects between legal and finance, and fix them

✅ Replace guesswork with real-time, line-level accrual data

✅ Avoid the risks of invoice-led reporting

✅ Track billing trends to support smarter forecasting

✅ Use spend monitoring tools to align legal and finance on the same data

Why legal e-billing remains an outlier in financial control

Most departments give finance what it needs to stay in control: timely visibility of committed costs, accurate forecasting, and clear reporting.

Legal is different—for good reason.

Matters often unfold unpredictably. External counsel is brought in to advise at speed. Scope can shift quickly. And unlike other functions, legal work is largely outsourced, making it harder to track in real time.

Costs accumulate before internal teams see the details. In many cases, the first clear view of spend only arrives with the invoice.

Accruals are logged manually (if at all). Work in progress is difficult to monitor. And getting a full picture of total exposure often means chasing law firms or cross-checking spreadsheets.

This isn’t a failure of process. It’s a byproduct of legal’s unique role—and the fact that most financial systems weren’t designed to handle outsourced legal work. But without a shared system to track what’s underway and what’s already been spent, legal and finance end up working in silos.

In high-stakes scenarios like M&A, litigation, or restructuring, even small blind spots in legal spend can throw off budgets, delay reporting, and create unnecessary exposure.

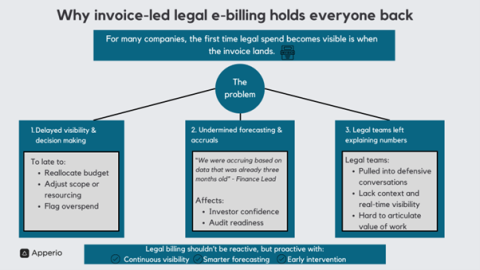

Why invoice-led legal e-billing holds everyone back

For many companies, the first time legal spend becomes visible is when the invoice lands.

That’s a problem, especially for finance.

1. It delays visibility and decision-making

By the time an invoice arrives, it’s too late to:

- Reallocate budget

- Adjust scope or resourcing

- Flag overspend before it hits the bottom line

Finance teams are left reacting to historic data rather than managing spend in real time.

2. It undermines forecasting and accruals

Manual spreadsheets and late billing make it hard to produce accurate accruals or defend forecasts.

“We were accruing based on data that was already three months old.” — Finance lead

This is a reporting headache, and it affects investor confidence, audit readiness, and month-end close timelines.

3. It leaves legal explaining numbers they didn’t see coming

Legal teams often get pulled into defensive conversations after the fact without context or real-time visibility into how spend is building. It’s harder to articulate the value of the work or maintain trust with finance and external counsel.

Legal e-billing shouldn’t be reactive. Like any significant business cost, it should be managed proactively, with continuous visibility, smarter forecasting, and early intervention when things go wrong.

From black box to audit-ready: Marex’s approach to legal e-billing

Marex, a NASDAQ-listed financial services platform, knows the challenge of managing legal spend without real-time visibility.

As the business scaled and regulatory scrutiny increased, legal costs became harder to track—and harder to justify. Spend was logged manually. Accruals were based on outdated spreadsheets. Finance had no view of unbilled work in progress. And for a public company, that lack of visibility posed a serious risk.

“Before Apperio, we would send out a spreadsheet to see spend—often with very approximate amounts.” — Suzanne Joynes, Cost Accountant

With Apperio, Marex introduced a single source of truth for legal spend. Accruals became automated. Finance could self-serve. Legal no longer had to field constant data requests.

“Massive time saving for the legal team as all the financial work can be done by the finance team... it cuts out 90% of the admin.” — Jason Vera-Torres, Head of Legal, Equities and Fund

The results:

- 90% reduction in manual admin for the legal team

- Faster month-end close

- 30% decrease in invoice delays from law firms

- Improved audit outcomes and reduced compliance burden

For a public company, this shift wasn’t just operational—it was strategic. Accurate, line-level accrual data gave Marex confidence in its reporting and audit readiness.

“Audit time, risk, and cost has reduced by using accurate real-time accrual data.” — Zdenka Mala, Financial Planning Analyst

“Apperio is the translator... helping translate legal value into CEO language.” — Jason Vera-Torres

Legal spend no longer sat outside the reporting process. It was visible, explainable, and aligned to how the rest of the business operated.

➡Read the full case study here.

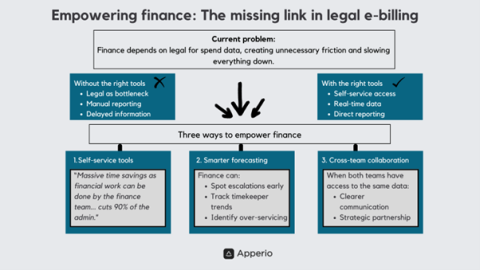

Empowering finance: The missing link in legal e-billing

For CFOs, relying on legal to provide spend data isn’t ideal.

Legal teams are focused on managing matters, not acting as a reporting function. And yet, without the right tools, finance often depends on legal to provide basic information like accruals, WIP, and matter status.

This creates unnecessary friction and slows everyone down.

1. Removing the bottleneck with self-service tools

Legal teams shouldn’t be the middlemen for financial reporting.

With legal e-billing tools like Apperio, finance teams can log in, run reports, and access real-time data—without waiting on legal to pull it manually.

“Massive time saving for the legal team as all the financial work can be done by the finance team... it cuts out 90% of the admin.”

— Jason Vera-Torres, Head of Legal, Equities and Fund

2. Tracking trends for smarter forecasting

Continuous visibility allows CFOs to:

- Spot cost escalations early

- Track timekeeper trends

- Identify over-servicing before the invoice lands

This takes finance from a reactive position to a proactive one, where decisions can be made before the spending hits the books.

3. Strengthening cross-team collaboration

When both legal and finance have access to the same data, conversations become clearer, faster, and more strategic.

The bottom line: When CFOs can continuously monitor legal spending, they can act faster and with more confidence. Misunderstandings reduce. Budget conversations improve. Legal is seen less as a cost center and more as a trusted partner driving business outcomes.

But getting that level of clarity isn’t just about mindset—it’s about having the right tools in place…

How spend monitoring tools bridge the gap

Legal and finance operate under different pressures, but both are accountable for financial discipline, especially in investor-backed or regulated environments.

Legal is focused on managing risk and outcomes. Finance is focused on precision, forecasting accuracy, and compliance. Without a shared system for tracking spend in progress, both teams are exposed—especially when the stakes are high.

Legal e-billing tools like Apperio provide that shared system, bringing continuous visibility, audit-ready accruals, and financial alignment to a long-disconnected area of the business.

1. Continuous visibility for in-progress matters

Legal work doesn’t follow neat monthly cycles. It ramps up quickly, spans jurisdictions, and often involves multiple external firms. Without real-time data on what’s been committed and accrued, finance is left reacting to surprises. Legal e-billing tools give both teams a live view of in-progress matters—including timekeeper activity, billing trends, and projected run rates—so costs can be monitored and managed as they build.

2. Financial governance that stands up to scrutiny

For publicly traded companies or those preparing for IPO, accrual accuracy and financial governance aren’t just best practices—they’re regulatory requirements. Manual tracking leaves gaps auditors can’t reconcile. Tools like Apperio automate line-level accruals, provide a full audit trail, and ensure spend is tracked consistently across firms, matters, and jurisdictions.

“Audit time, risk, and cost has reduced by using accurate real-time accrual data.”

— Zdenka Mala, Financial Planning Analyst

3. Data transparency that improves performance

When both legal and finance work from the same live data, it becomes easier to evaluate value, not just cost. Which matters are escalating? Which firms are under- or over-performing? Which timekeepers are delivering efficiency? Shared visibility allows for smarter law firm management, better budget control, and more strategic vendor decisions.

“Apperio is the translator… helping translate legal value into CEO language.” — Jason Vera-Torres, Head of Legal, Equities and Fund

4. Stronger investor confidence

Delayed or inaccurate legal accruals don’t just affect month-end close—they impact overall financial credibility. In high-growth or capital-intensive environments, investor confidence depends on the business’s ability to demonstrate control over all spend, including legal. With real-time legal e-billing data, CFOs can answer questions with precision, not estimates.

In the next section, we’ll look at how these insights enable smarter, more proactive financial decision-making.

The CFO’s opportunity: Turning legal data into business value

For CFOs, legal spend has traditionally been one of the hardest cost centres to manage—variable, relationship-driven, and often disconnected from the systems used to track and control other types of spend.

But that’s changing.

With the right data infrastructure in place, legal spend becomes measurable, predictable, and (crucially) strategic.

1. Move from after-the-fact analysis to proactive oversight

With continuous visibility into in-progress matters, CFOs can see cost accumulation before it hits the P&L. That means:

- Identifying escalating matters early

- Tracking timekeeper resourcing and rate variances

- Intervening on scope or fee arrangements before overspend occurs

This is particularly important when managing portfolios of matters across multiple firms, jurisdictions, or business units, where even small variances can scale into material deviations.

2. Strengthen forecasting, accruals, and governance

High-growth and investor-backed businesses are under pressure to deliver tighter forecasts, faster month-end closes, and audit-readiness at all times.

With line-level legal e-billing data, CFOs can:

- Automate accrual capture with a full audit trail

- Defend forecasts with real-time supporting data

- Reduce reliance on law firm responsiveness for reporting accuracy

This becomes even more critical during IPO preparation, M&A events, or when under regulatory scrutiny, when financial governance must extend to every line of spending, including legal.

3. Benchmark and optimise legal value

When CFOs have access to firm-by-firm, matter-by-matter data, it becomes easier to benchmark legal spend by firm, by outcome, by efficiency.

That unlocks:

- More informed panel reviews

- Stronger fee negotiations

- Clearer insight into where legal is enabling or diluting business value

This move—from “what did we spend?” to “what did we get for it?”—takes legal from a passive cost to an active contributor to the business strategy.

For CFOs, the opportunity isn’t just to track legal costs more closely. It also means you can bring legal into the same financial discipline applied everywhere else—making it forecastable, measurable, and fit for board-level conversations.

Here’s how to make this happen. ⬇

From reactive to ready: The CFO’s legal e-billing playbook

Legal spend no longer needs to sit outside your financial model. With the right tools and approach, CFOs can manage legal costs with the same rigour and predictability applied to every other business function.

1. Treat legal as a managed cost, not a post-event adjustment

Continuous monitoring gives you a real-time view of what’s been spent, what’s been committed, and where cost is building. No more waiting for invoices. No more manual accruals. No more surprises.

This isn’t just about improving visibility—it’s about reducing volatility and improving financial agility.

2. Build a shared system between legal and finance

Legal teams aren’t set up to act as data providers for finance. And finance teams shouldn’t need to chase law firms for updates. By implementing legal e-billing tools like Apperio, you give both teams access to the same structured, real-time data, reducing friction and improving decision-making across the board.

3. Reframe legal as a strategic contributor

When legal spend is measured, benchmarked, and tied to business outcomes, the conversation shifts. Legal moves from cost centre to business enabler—supporting risk management, growth, and strategic execution.

Legal doesn’t need to be a financial black box. With the right infrastructure in place, it becomes another area of the business you can forecast, manage, and explain with confidence.

Ready to make legal spend as predictable as the rest of your business? See how Apperio can help. Book a demo.