Legal e-billing software isn’t broken. You’re just asking it to do the wrong job

Traditional legal e-billing software gets a lot of blame. When matters run over budget or costs spiral unexpectedly, it’s tempting to point the finger at the tools designed to control spend. But let’s remember: invoicing software was never built to control spend. It was built to process it.

Invoice-focused e-billing platforms do what they’re supposed to: they automate billing workflows, flag non-compliance, and log costs against budgets. They make life easier for legal ops. But if you’re relying on them to prevent overspend, you’ll always be one step behind. By the time the invoice arrives, the cost is already baked in.

This blog looks at what legal spend management software is really for, why it fails to give finance the visibility it needs, and what legal teams should be doing instead to get ahead of costs.

What legal e-billing software is built for

Traditional e-billing platforms exist to streamline the mechanics of billing, not the management of spending.

They’re built for:

- ✅Automating billing workflows: Routing invoices for approval, applying templates, and removing manual steps.

- ✅Ensuring compliance: Checking invoices against outside counsel guidelines (OCGs), flagging line-item breaches, and enforcing billing rules.

- ✅Tracking costs post-fact: Logging spend against budgets for reconciliation and reporting purposes.

These capabilities matter, of course. They sometimes reduce admin, standardise processes, and make billing more manageable, especially for legal operations teams handling high invoice volumes.

But they are, by design, reactive. They tell you what you’ve spent, not what you’re spending. They track what’s already happened, not what’s about to go wrong.

And that’s where the disconnect lies. Traditional e-billing software is an execution tool. It plays a valuable role at the end of the spend lifecycle, but it can’t help you manage costs during the lifecycle, when action is still possible.

Why legal e-billing software fails at proactive spend control

The primary issue with relying on traditional e-billing software for cost control is that it can only work with the data it’s given. By the time an invoice is submitted, you’re dealing with completed work and costs that have already been incurred. This leaves little room for course correction or proactive management.

Consider this: a matter may be progressing smoothly from a project management perspective — tasks are getting done, milestones are hit, and everything looks green. But this snapshot ignores critical financial signals like:

- ❌Scope creep: Small changes in scope can drive up costs, but unless tracked continuously, they won’t show up until it’s too late.

- ❌Fee earner stacking: Multiple senior associates working on a matter may be a red flag for unnecessary cost, but invoicing tools don’t highlight this until the billing stage.

- ❌Inefficient staffing: A matter may be “on track” operationally, but poor resourcing decisions (like overstaffing or not using the right billable time) can significantly increase costs.

Without continuous visibility into current spend data — WIP, accruals, team structure, billing patterns — these financial risks can go unnoticed until the invoice lands. By then, it’s too late for corrective action.

The real reasons budgets still get blown (even with ‘good’ e-billing tech)

So why, despite having invoicing software in place, do budgets still go over? The answer lies in a misalignment between operational progress and financial performance.

Traditional e-billing software captures billing data, but it doesn’t capture the entire picture. By focusing solely on invoice approvals and compliance, teams miss out on key financial signals that arise during the course of a matter. This leads to:

- ❌Missed red flags early in the process: Without tracking live spend, legal and finance teams can’t spot when costs start deviating from budget until after the fact.

- ❌Delayed decision-making: By the time an issue is flagged, it’s usually too late to take corrective action. In many cases, there’s little opportunity to renegotiate, reassign resources, or adjust the scope.

- ❌Increased reliance on retrospective analysis: While invoicing software helps reconcile final costs, it doesn’t provide the granular, real-time insights needed for proactive decision-making.

Even the best AI-enabled traditional e-billing systems can’t catch these issues, because they were never designed to manage spend proactively. They serve a purpose but they’re not equipped to stop overspend before it happens.

What GCs and CFOs should be tracking before the invoice

If legal e-billing software can’t catch spend before it happens, what should legal and finance teams be tracking? The answer is a more comprehensive approach that combines matter tracking with financial oversight.

Here are the key indicators that should be monitored proactively, long before an invoice lands:

🚩Fee earner allocation

Track how many individuals are billing time to a matter, and at what levels. A high concentration of senior associates, for example, may signal inefficiency and unnecessary costs. Ideally, this should be balanced with cost-effective junior staff or paralegals.

🚩Gearing ratios

Monitor the mix of senior and junior staff on a matter. A proper mix — using senior associates where necessary, but leveraging more junior staff for routine work — is essential for keeping costs under control.

🚩Scope changes

Scope creep is one of the most common causes of budget overruns. Tracking changes in hours, team size, or matter duration against the original scope helps identify when a matter is starting to veer off course.

🚩Budget burn rate

Tracking how much of the budget has been used at each stage of the matter allows teams to identify when they’re burning through the budget too quickly. If you’re halfway through a matter but have already burned 80% of the budget, that’s a red flag (regardless of progress).

🚩Accrual and invoice variance

Regularly check how accurate the accruals and WIP are in comparison to the final invoice. Large or repeated discrepancies can indicate poor forecasting and mismanagement of budgets.

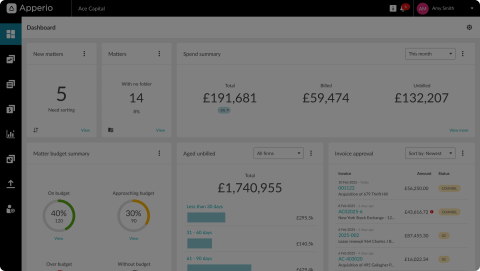

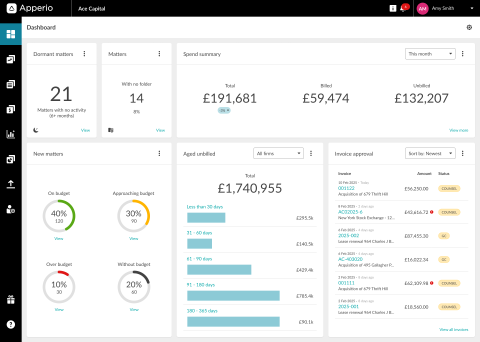

This is where a tool like Apperio can help. By bringing these financial metrics into your matter-tracking process, you can proactively identify issues before they become budget-busting problems.

The case for pairing legal e-billing software with continuous oversight

Now that we’ve established why traditional legal e-billing software lets you down, the solution is clear: you need to pair it with continuous financial oversight. In other words, combine matter management with spend tracking for a complete, current picture of both operational progress and budget health.

Here's how this pairing works:

✅Track both progress and spend simultaneously

By integrating legal e-billing software with continuous spend monitoring tools like Apperio, you can ensure that operational milestones align with the financial performance of a matter. You’ll have visibility into both the task list and the budget at the same time, allowing you to spot deviations early.

✅Provide your teams access to early insights

Instead of waiting for the invoice to land and then scrambling to adjust, continuous oversight gives legal and finance teams the chance to make adjustments while the matter is still in progress. If fees are escalating, you can intervene before it becomes a problem.

✅Maintain transparency with your law firms

A combined approach improves communication with external counsel. With clear visibility into both operational progress and cost, you can have more constructive, proactive conversations about cost management and set clearer expectations upfront.

✅Turn insights into actions

Continuous tracking flags problems and it allows you to take action. By monitoring financial performance alongside matter progress, you can make informed decisions that directly impact the success of the matter, the quality of the relationship with your law firms, and the bottom line.

Pairing legal e-billing software with continuous oversight is a smarter way to handle legal spend management. And it’s a model that’s already working for the leading corporate and private equity legal teams who use Apperio.

Ready to gain real-time insights into your legal spend? Book a demo with Apperio today to see how our solution can help you gain full control over both matter progress and spend.