Budgeting and forecasting software for Legal: Why you need to ditch generic

Spreadsheets, ERP modules, and e-billing platforms remain the default for legal budgeting. Often, this is because they’re already embedded in business workflows. But when it comes to forecasting legal spend, these tools are reactive. They weren’t built for a reality where matters open with incomplete scope, evolve quickly, and generate costs long before an invoice appears.

The result? Budgets can only be based on best guesses. Forecasts become quickly outdated. And spend visibility often arrives after the opportunity to take action has passed.

What’s needed is a more integrated approach that brings budgeting, tracking, and performance management closer to where the work is actually happening. Here’s why…

Why legacy tools don’t fit legal budgeting

Spreadsheets and ERP systems are often common in legal departments because they align with infrastructure and are already in place. However, they were designed for predictable and repeatable cost structures. But legal matters don’t follow that pattern.

Here’s where the disconnect happens:

- No link between scope and spend. Spreadsheets and ERP systems track financials, but not scope changes. When a matter expands, there’s no structured way to assess the financial impact until it’s too late.

Static inputs. They rely on historical averages or manual tweaks, which don’t reflect the variability of active matters, where staffing, jurisdiction, or deal terms can affect costs. - Lack of context. They show numbers, but not the reasons behind them. There’s no visibility into why spend is rising or where risks are emerging.

- Delayed response. Quarterly forecasts often land after the spend has already exceeded budget.

For forecasting to be credible, it needs to be matter-led, context-aware, and updated continuously. Legal work doesn’t operate in hindsight, and neither should the systems used to manage its cost.

The pressure is intensifying across the board. According to Axiom’s In-House Legal Budgeting Survey, 96% of GCs suffered budget slashes in 2023, by an average of 11%. At the same time, legal work is expanding, yet most departments are still managing this complexity with tools designed for predictable, static cost structures.

Why traditional e-billing isn’t the solution either

To fill the gaps left by spreadsheets and ERP systems, many teams turn to e-billing tools. These platforms were designed to standardize invoices and ensure compliance but they don’t support active forecasting or budget management.

This creates a major disconnect between workload and visibility. Nearly 60% of legal departments report increased work demands, while almost 30% have had to cut back on spending. E-billing tools, focused on compliance rather than active management, can’t bridge this gap.

In practice, e-billing tools introduce their own limitations:

- They start with the invoice. But that’s too late. Forecasting should begin before the work does.

- Budgets are disconnected. Some tools let you set a budget, but they don’t track how work is progressing against it.

- Alerts come after the fact. By the time a system flags an issue, the overage has already occurred.

- No commercial context. E-billing captures cost, but not whether the work stayed within scope or delivered the expected value.

To manage legal spend effectively, you need visibility from day one. Forecasting, tracking, and evaluation must work together. That’s what modern budgeting and forecasting software should enable.

Setting budgets based on real pricing

Many legal budgets still rely on internal estimates or past matters. These inputs can help orient a plan, but they don’t reflect the actual cost of the work ahead.

Reliable budgeting starts during an engagement. When legal teams use structured RFPs to gather comparable proposals, they can base budgets on market-aligned pricing for the specific matter.

This delivers:

✅Clear expectations. Scope, delivery method, and commercial terms are defined before work begins.

✅Budget discipline. Side-by-side comparisons highlight outliers and support better fee structures.

✅Alignment with finance. Budgets reflect current market rates, not internal assumptions.

Structured RFPs also support strategic alignment beyond pricing. They surface assumptions around resourcing, timelines, and delivery phases, creating space for early negotiation and better-informed internal conversations. Finance leaders gain confidence that legal budgets are based on real inputs, not internal forecasts shaped by pressure or precedent.

Once agreed, that budget becomes the foundation for live tracking and performance review. This is where traditional budgeting tools typically stop but where leading budgeting and forecasting software continues to add value.

Connecting the full lifecycle: From budget to outcome

Instead of treating budgeting as a single point in time, legal spend needs to be managed as a process, from engagement to completion.

A best practice approach connects how a matter is scoped, how it’s managed in progress, and how its performance is assessed once it’s closed. Leading legal and finance teams are already adopting this model, supported by integrated tools that ensure nothing falls through the gaps.

"We heard that Apperio was capable of seeing WIP live within law firms billing systems. And that was highly attractive to us because not only would we gather accurate data, but of course the lag is removed. So we were killing multiple birds in one stone. And also it had the additional benefit that MI could be tracked back towards the budget." - Tamara Franks, Head of Operations, Group General Counsel, USS

Here’s what that looks like in practice:

1. Scoping and engagement.

Legal teams gather proposals through structured RFPs. PERSUIT enables this with side-by-side comparisons of scope, pricing, and delivery plans. This stage is also an opportunity to challenge inflated assumptions, clarify expectations, and establish commercial alignment before costs are locked in.

2. Budget setup and approval.

Once selected, the approved budget is passed directly into Apperio (no manual re-entry required). That connection avoids version control issues and ensures that the numbers being tracked match the scope that was agreed. Essentially, it creates a single source of truth for both legal and finance.

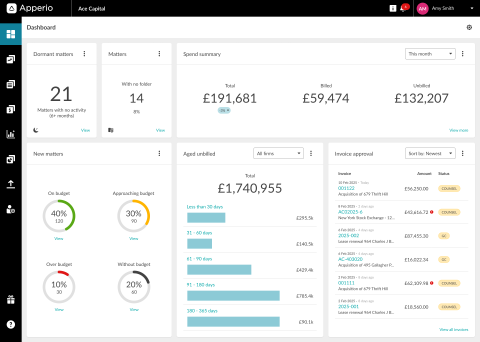

3. Live matter tracking.

Then, Apperio monitors spend as the work progresses. Legal and finance teams can track the matter's progress by phase, timekeeper, or firm. This helps identify where scope is drifting, where resources may not match the plan, and where reforecasting is needed. Small interventions can happen early, when they’re easier to address.

4. Invoice and delivery review.

At completion, Apperio compares the final invoice to the original proposal. It shows what was delivered, how it was billed, and whether it stayed within the original scope and fee structure. This process helps you understand whether the matter delivered the value expected.

5. Performance feedback.

That delivery data flows back into PERSUIT, where it becomes part of future firm selection and evaluation. Legal teams can assess whether firms delivered to plan, maintained budget discipline, and collaborated effectively. This closes the loop and creates a performance record that improves future engagement decisions.

This connected process helps legal and finance move beyond reactive cost control. It supports better engagement decisions, stronger financial alignment, and greater predictability across matters and firm relationships.

Why forecasting can still fail and how to fix it

It’s important to note that even with budgeting and forecasting software in place, if a legal department still struggles to produce accurate forecasts, the issue may be in the way the process is owned, maintained, and integrated across the legal-finance partnership.

Common failure points include:

- Siloed ownership. When budgeting sits solely with legal or finance, communication gaps often appear.

- One-off planning cycles. Forecasts built quarterly or annually, with no mechanism for in-cycle updates, go stale fast.

-

No performance feedback. Without post-matter data, there’s no way to improve forecasting quality over time.

Fixing these issues requires a coordinated approach where budgeting and forecasting software is embedded into legal operations, and where both teams rely on shared data to adjust plans in real time.

Forecasting legal spend requires a complete view

Forecasting legal spend depends on visibility at every stage of a matter, including scoping, budgeting, tracking, and review. When these are disconnected, surprises happen. Overspend goes unnoticed. Performance is hard to measure and manage.

PERSUIT and Apperio help legal departments bring the pieces together. Used in combination, they support stronger forecasting and more consistent decision-making.

How Apperio and PERSUIT work together

PERSUIT enables upfront budget creation through competitive RFPs, using pricing transparency to set realistic budgets from day one. Once approved, those budgets are passed directly into Apperio.

Apperio automatically receives the budget and monitors live spend as the work happens. It flags risks and changes in real time, and once the matter is complete, it captures what was delivered and how. That data is then fed back into PERSUIT to support performance management and smarter firm selection going forward.

Together, the two platforms provide a connected, end-to-end approach to managing legal spend (from scope to selection to outcome).

Want to see how it works in practice? Get in touch for a closer look at how Apperio and PERSUIT can help improve your legal budgeting and forecasting process.