Legal e-billing software: Rewriting the rulebook to select firms by performance

When firms are appointed to a panel, the decision is often framed as a vote of confidence. But confidence in what, exactly? Many in-house teams continue to rely on internal reputation, familiarity, or past relationships… despite having years of billing data, often surfaced through legal e-billing software, that tells a more accurate story.

This disconnect has consequences. Panels that look consistent on paper can behave very differently in practice. The same firms appear across multiple portfolios, but their performance, billing behavior, and cost predictability vary widely. Without clear visibility into that detail, firms are selected on feel, not fact, and the same billing issues repeat under a different matter name.

There’s a better way to do this.

Legal and finance teams that bring billing data into firm selection conversations are gaining a clear edge: fewer surprises, better outcomes, and stronger internal justification for their decisions. Not by reinventing the panel process but by grounding it in performance.

Why firm selection often lacks real oversight

Panel appointments tend to carry weight. They imply credibility, commercial alignment, and proven delivery. But the reality is that many of these decisions are made without meaningful scrutiny of how firms have actually performed.

That’s not a reflection of poor judgment. It’s often the result of fragmented data. Billing information might sit in spreadsheets, finance systems, or with individual matter leads — rarely in one place, and almost never analyzed in context. The finance team may track overall spend, but the legal team lacks visibility into patterns that matter: where scope regularly drifts, which firms over-resource, how often budgets are revised mid-matter.

In the absence of clear performance data, decisions default to what’s familiar. This creates a blind spot. Firms that operate inconsistently across matters are treated as safe bets, while more disciplined performers can be overlooked simply because the data isn’t visible.

For legal functions under pressure to demonstrate control and accountability, that’s a risk in spend and governance.

What billing data really tells you

It’s easy to assume billing data is just a reflection of time and rates. These are useful for reconciliation, but not much else. In practice, it reveals how firms actually operate. When properly surfaced, it shows patterns beyond cost.

Billing data helps legal teams identify:

- Staffing behaviors: Are firms over-relying on senior fee earners for low-complexity work? Is there consistent gearing discipline?

- Scope adherence: How often do matters drift beyond the original brief? Are changes flagged early or buried in final invoices?

- Phase performance: Which firms deliver predictably across different phases of a matter? Where are overruns concentrated?

- Discount patterns and write-offs: Are savings planned or reactive? Do firms regularly course-correct through last-minute discounts?

These insights don’t come from a single invoice, or even a handful. They emerge across matters, over time. With that broader view, billing data becomes a lens on firm reliability, working style, and commercial alignment.

It’s the kind of evidence that belongs at the center of any panel review. Without it, firm performance cannot be measured.

Building a performance framework with legal e-billing software

Once billing data is centralized and reviewed in context, it becomes the foundation for a more structured, repeatable approach to firm evaluation. Rather than relying on subjective feedback or one-off experiences, legal teams can establish clear internal benchmarks, grounded in how firms have delivered across comparable matters.

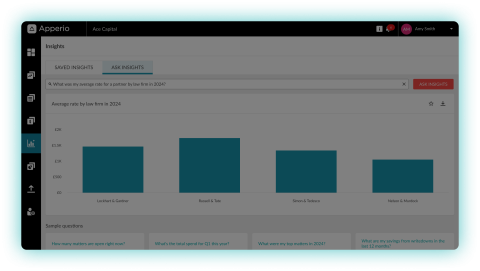

This is where legal e-billing software plays a major role. It allows legal and finance teams to:

✅Track consistency across matters: Spend, scope discipline, team structure, and budget adherence.

✅Compare like-for-like performance: Cost per matter type, phase-level accuracy, and staffing efficiency across similar engagements.

✅Spot anomalies early: Sudden changes in timekeeper mix, repeated use of high-cost resources, or delayed billing.

✅Support conversations with data: Giving in-house leads the ability to discuss performance trends with clarity, not conjecture.

Over time, this moves legal teams closer to a defensible performance framework — one that can support panel decisions, firm renewals, and pricing discussions without relying on institutional memory. It also creates a stronger position when justifying panel composition to procurement or the CFO, particularly in cost-sensitive environments.

Closing the performance loop: visibility and action, working together

Identifying performance patterns is one thing. Acting on them is where the real value lies. This is where having the right combination of tools allows for better coordination between them.

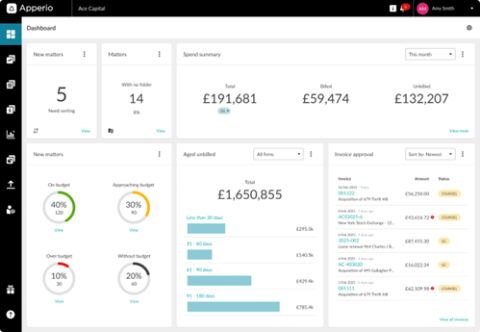

Apperio gives in-house teams visibility into how firms behave financially: where budgets hold, where they slip, and how those patterns evolve across timekeepers, phases, and matter types. Say goodbye to retrospective analysis. Real-time oversight enables proactive course correction.

But visibility is only half of the equation. Once the data reveals what’s working and what isn’t legal teams need a way to reflect that insight in how new work is scoped, priced, and assigned. This is where PERSUIT fits naturally.

By combining Apperio’s billing intelligence with PERSUIT’s structured firm engagement workflows, teams can:

- Scope work in line with known performance strengths

- Select firms based on data

- Design pricing models that match delivery history

- Build in expectations from the start and track whether they’re met

This creates a closed loop: firms are chosen based on their performance, and are monitored continuously once appointed. Over time, legal teams move from passive oversight to active management, with fewer surprises, better outcomes, and stronger internal alignment around value.

What this looks like in practice

In-house teams, particularly those managing multiple firms across business units or portfolios, are already using billing data to shape firm engagement strategies in more deliberate ways.

For example: a Private Equity firm reviewed two years of billing data across its core panel. One of its preferred firms, widely viewed as a safe pair of hands, consistently came in 20–25% over budget on mid-value matters. The pattern wasn’t isolated — it showed up across different matter types, with similar overuse of senior timekeepers and repeated write-offs at the final invoice.

Rather than immediately rotating the firm off the panel, the team used Apperio to surface these patterns clearly and transparently and opened a conversation. They agreed to pilot a new scoping approach through PERSUIT, narrowing the fee structure, confirming staffing expectations up front, and applying stricter phase-level checkpoints.

The result? Fewer billing disputes, better predictability, and a firmer basis for ongoing relationship management. The firm stayed on the panel but under terms shaped by actual performance.

Why legal e-billing software belongs in your firm selection process

Selecting firms based on reputation or internal preference may be common practice, but it no longer meets the standard expected of today’s in-house legal teams. When legal budgets are under pressure and decisions are subject to greater internal scrutiny, panels need to be built on performance, not perception.

Legal e-billing software gives legal and finance teams the insight required to make that advancement. It captures how much was billed and how firms operate: whether they respect scope, resource matters appropriately, and deliver consistently across phases. These patterns, once visible, become a foundation for smarter engagement, better pricing, and stronger results.

Performance-based firm selection is already happening. And the teams that build it into their process are better equipped to justify spend, defend decisions, and drive outcomes that align with the business.

Want to see what your billing data could tell you about firm performance? Get in touch for a demo.