Legal billing programs or outside counsel management: What should you prioritize?

Legal teams looking to improve cost control often face a familiar decision: invest more in their current legal billing program, or move toward an end-to-end outside counsel management solution. Both may sound similar on paper. But only one is designed to influence spend while the work is still in progress.

The pressure is real. According to the ACC, 42% of departments received a mandate to cut legal costs while 58% experienced a major hike by their law firms. Legal teams are caught in a squeeze, expected to deliver more while spending less. Often with limited visibility into where their money actually goes.

The problem is most legal billing tools are built to catch problems, but, they catch them too late.

When invoices reveal budget overruns or scope creep, the work is done, and the money is spent. Legal couldn't influence costs, and Finance got blindsided by unexpected changes. Billing-first systems only track what's already happened, monitoring compliance rather than performance, and providing documentation without control.

This blog takes a closer look at the challenges with legal billing programs, the operational risk of relying on invoice-only data, and what senior legal and finance teams are prioritizing instead.

Why legal billing programs alone don’t give you full control

Legal billing programs were designed to solve a specific problem: bringing structure to invoice review. And within that narrow remit, they work. They help enforce agreed rates, reduce admin, and create a clear record of what was billed.

But here’s what billing tools don’t provide:

❌They don’t support firm selection

Billing tools step in once work is already in progress. They offer no mechanism for evaluating whether the firm was the right choice, whether the fee structure suits the matter, or whether commercial value was properly defined upfront.

❌They don’t track alignment with scope

Time entries and line items tell you what was done but not whether it was necessary, expected, or in scope. Without visibility into scope drift, as it happens, legal teams are left identifying issues after the budget has already moved.

❌They don’t surface budget warnings early

Most billing systems show cost data only after it's been finalized. That delays your ability to act. By the time a matter runs over budget, it’s too late to correct the course.

❌They don’t provide operational oversight

An invoice shows who worked on something and for how long but not whether the staffing model made sense, whether senior resources were overused, or whether timelines were realistic. It’s a snapshot, not a source of insight.

❌They’re not designed for collaboration with finance

Legal billing systems help legal review invoices. They don’t provide the kind of continuous, structured spend data finance teams need for forecasting, accruals, and cost confidence.

This lack of continuous oversight causes several issues.

💡Did you know? Apperio was built to solve this by providing legal and finance with shared, continuous visibility into live legal work, budget progression, and key spend drivers. Find out more.

The true cost of relying on invoice-stage visibility

When billing data only appears after the fact, the impact extends beyond operational inefficiency. It introduces risk.

Here’s what happens when billing tools are your only window into spend:

➡Budget surprises become the norm

Legal approves invoices it didn’t expect. Finance is left chasing explanations at quarter-end. There’s no opportunity to intervene, redirect, or challenge spend in-flight.

➡Forecasts lose credibility

Without visibility into what’s building beneath the surface, legal becomes a black box in the budget. Accruals rely on guesswork. Finance starts questioning whether legal’s numbers are grounded in reality.

➡Negotiation leverage disappears

When issues are only raised at the point of invoicing, legal loses the ability to influence outcomes. It becomes a retrospective process.

➡Firm relationships suffer

Disputes over surprise invoices slow down payments, increase friction, and create misalignment in value. Without shared, real-time context, both sides feel like they’re working blind.

The costs of invoice-only systems are cumulative and the longer they go unaddressed, the harder it becomes to build trust between legal, finance, and firms.

How legal billing programs compare to outside counsel management

Legal teams already know billing tools have limits. To more easily highlight the differences between that and outside counsel management platforms, we’ve compared the two side-by-side:

Legal billing programs |

Outside counsel management platforms |

| Visibility begin until the invoice | Visibility begins before work starts |

| Tracks compliance with billing rules | Enables proactive management of scope, cost, and performance throughout |

| Retrospective reporting | Continuous oversight during delivery |

| Limited to only enforcing rates | Helps define pricing and value upfront |

| Supports invoice review | Supports budgeting and performance tracking |

| Legal-only tool | Designed for legal and finance collaboration |

| Provides documentation only | Enables real-time decisions and forecasting |

The bottom line is this: Legal billing programs were built to track what’s already happened. Outside counsel management platforms are designed to provide legal and finance teams with the visibility they need while the work is still underway, allowing them to stay in control from start to finish. And that visibility also strengthens trust.

With the right data in place — from budget adherence to billing behavior — legal and finance teams can see which firms consistently meet expectations. That makes it easier to reward reliability, reduce unnecessary oversight, and have clearer conversations when something’s off.

📕Read more: The trust scorecard: Smarter outside counsel management

Apperio already captures many of these trust indicators. Used consistently, they form the foundation for more transparent, data-informed relationships with your law firms.

What to prioritize: continuous legal spend management

Leading teams are moving away from disconnected tools and towards integrated solutions for proactive management of how legal work is scoped, performed, and paid.

It starts with better decisions upfront. Selecting the right firm. Choosing the right pricing model. Setting expectations before work begins. That’s where PERSUIT brings discipline and transparency to the selection of outside counsel.

But selection isn’t enough on its own.

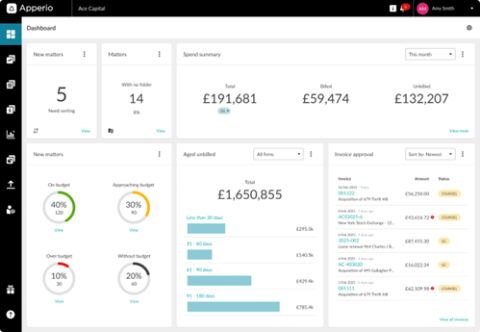

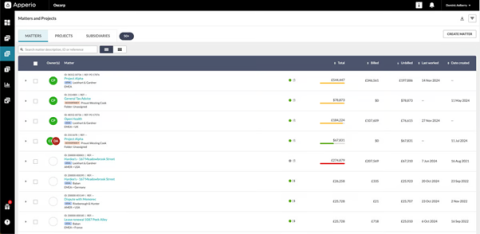

As the work unfolds, legal and finance need ongoing visibility into timekeepers, budgets, staffing, and delivery pace. That’s where Apperio provides the in-matter tracking needed to prevent surprises before the invoice lands.

Together, this creates a feedback loop that improves budgeting, supports accurate forecasting, and enables stronger performance conversations with firms. It also gives finance live visibility into legal spend, making legal a true partner in financial planning.

If your tools only show you the past, you're already behind

Legal billing programs still have a role. They bring structure to invoice review and help enforce billing compliance. But if your only source of spend insight arrives at the point of invoicing, you’re already behind.

Control comes from continuous oversight from firm selection through to final delivery. That means understanding value before the work begins, and staying aligned while the work is still in motion.

For teams looking to take that next step, an integrated approach is key.

PERSUIT provides the upfront control.

Apperio delivers the in-matter visibility.

Together, they offer legal and finance teams a smarter, end-to-end way to manage external legal spend.

Get in touch to see how the two platforms work together to deliver greater control, better forecasting, and fewer surprises.

Keen to learn more? Here’s a quick intro to the Appero and PERSUIT partnership. ⬇

How Apperio and PERSUIT work together

Apperio and PERSUIT offer complementary solutions that give legal and finance teams full visibility and control across the lifecycle of external work.

- PERSUIT supports vendor selection and upfront scoping. It helps legal teams run competitive RFPs, compare fee structures, and make better-informed choices before work begins.

- Apperio tracks live spend once the engagement is underway. It monitors timekeepers, budgets, and scope evolution, allowing legal and finance to stay aligned and avoid last-minute surprises.

Together, we deliver an end-to-end solution for smarter legal spend management, from selection through to completion.