Preparing for 2026: Why Limited Partners will expect more transparency on legal spend

Fundraising in Private Equity is getting tougher. Limited Partners (LPs) are looking deeper into fund costs, and legal spend management is beginning to attract more attention.

Inside firms, the picture is often messy. Private Equity legal teams hold the budgets, but deal teams are the ones engaging outside counsel when transactions move quickly. Finance then has to explain the numbers to investors, often without reliable forecasts to lean on. By the time invoices arrive, it’s too late to adjust.

That lack of visibility creates more than frustration. To investors, it raises questions about financial discipline. And with US fundraising in the first half of 2025 down to $592 billion, the lowest since 2018, those questions are only likely to get sharper in 2026.

The firms that can present a clear, data-backed view of Private Equity legal costs will be in a stronger position to reassure LPs and build confidence ahead of the next raise.

This article covers:

- Why LPs are likely to scrutinise fund-level legal costs more closely in 2026

- How variance between budgeted and actual spend signals governance issues

- Why fragmented billing practices across portfolio companies erode confidence

- How reliable spend data and panel discipline can differentiate firms with LPs

- Practical steps to prepare now for 2026 fundraising conversations

Why LPs are likely to scrutinise fund-level legal costs more closely in 2026

Legal spend has rarely been the headline item in a fundraising conversation, but that is starting to change. Limited Partners are under their own pressures: pension funds, endowments, and sovereign wealth funds are dealing with tighter return targets and increased scrutiny from their investment committees.

And that pressure travels downstream. When LPs review a Private Equity firm’s materials, they now look beyond performance multiples to the governance practices that support them.

That wider focus on governance is bringing Private Equity legal costs into sharper view…

Legal costs are firmly part of that picture. A fund may spend millions each year on outside counsel for deal flow, fund structuring, and regulatory work.

Historically, these costs were absorbed as part of doing business. In 2026, LPs are more likely to ask:

- How predictable are these costs?

- How consistently are they managed across funds and portfolio companies?

- How do they affect the net returns we see?

Transparency is becoming essential. According to ILPA guidance, LPs are requesting more granular reporting on fund expenses, including transaction-related legal fees. Unexplained swings are no longer dismissed as market noise. They raise doubts about operational discipline. A firm may point to a one-off regulatory hurdle or cross-border issue, but without reliable data those explanations carry little weight.

Scrutiny is intensifying. The Private Funds CFO Insights Survey 2025 found that more than 60% of managers say LPs have increased their focus on back-office functions over the past three years, and 91% say this scrutiny has sharpened in the past year alone.

Fundraising conditions add to the pressure. With US private equity raising $592 billion in the first half of 2025, LPs are in a stronger position to demand detail and accountability. Legal spend is becoming a proxy for how tightly a firm manages one of its largest controllable costs outside management fees and carry.

A marker of fund quality. LPs do not expect legal costs to vanish, but they will expect firms to show that costs are understood, forecasted, and managed with the same discipline as other fund expenses. Firms that cannot provide that clarity risk losing ground to peers who can.

How variance between budgeted and actual spend signals governance issues

Forecasting shapes how investors judge a firm’s control over its operations. When budgets and actuals diverge, the numbers tell a story: either of discipline or of gaps that need explaining.

| What LPs notice | What it suggests | How leading firms address it |

| Budgets consistently overshoot actual spend | Forecasting is unreliable | Linking budgets to virtually live spend data for early course correction |

| Similar matters regularly exceed expected costs | Lessons from past deals aren’t being applied | Using historical data and benchmarks to set more accurate budgets |

| Explanations based only on “one-off events” | Limited transparency or poor documentation | Capturing variance data in real time to support a credible narrative |

| Overruns only surface at invoice stage | Private Equity legal costs managed reactively | Monitoring work-in-progress costs to adjust before invoices arrive |

For LPs, it isn’t the absolute size of the bill that matters. It’s whether the firm can show that variances are understood, tracked, and managed. Firms that present this level of control build trust. Firms that cannot risk undermining investor confidence at the very moment they need it most.

Why fragmented billing practices across portfolio companies erode confidence

Private Equity firms rarely operate with a single, consistent approach to legal spend. Each portfolio company often engages its own law firms under different terms, with little central oversight. On the surface, this may look like business as usual, but to LPs it signals something else: missed value and weak governance.

- ❌Different matters, different rates. When portfolio companies pay materially different fees for similar work, it suggests there is no panel discipline and no effort to capture economies of scale.

- ❌Inconsistent guidelines. If billing rules and approvals vary by company, spend management appears patchy. Oversight looks uneven, raising questions about governance.

- ❌Duplication of effort. Without visibility across companies, law firms may be instructed separately to do near-identical work. That duplication points to inefficiency and a lack of control.

- ❌No consolidated view. When portfolio-level spend cannot be shown in one place, firms lose bargaining power with outside counsel and the ability to demonstrate governance strength.

LPs read fragmentation as value left on the table. A firm that can present a consolidated, consistent picture of legal spend across its portfolio demonstrates discipline, leverage with law firms, and stronger control of a key cost line.

How reliable spend data and panel discipline can differentiate firms with LPs

Fundraising in 2026 will be highly competitive. LPs are weighing not only returns but also the practices that sit behind them. Legal spend is becoming one way to separate firms that manage costs with discipline from those that allow them to drift.

- ✅Reliable data creates confidence. When a firm can present spend figures that tie budgets to actuals — with clear explanations for any variances — it gives investors confidence that costs are understood and controlled. LPs will accept that spend fluctuates; what they want to see is discipline in how it is managed.

- ✅Panel discipline signals maturity. Enforcing consistent billing guidelines across matters and portfolio companies shows that outside counsel are being managed strategically. This prevents unnecessary spend and strengthens the firm’s position in negotiations. LPs read that as operational maturity.

- ✅Consistency builds trust. The differentiator is not a single year of savings but a repeatable process. Firms that can show accurate budgets year after year, consistent billing practices, and minimal disputes demonstrate a culture of discipline.

In a fundraising climate where capital is harder to secure, these practices become part of the story. Legal spend may not determine allocation on its own, but it can tip the balance when LPs compare managers. The firms that present reliable, auditable data alongside clear panel discipline will stand out as stronger stewards of investor capital.

Practical steps to prepare now for 2026 fundraising conversations

LPs will expect legal spend transparency to feature in fundraising discussions next year. Firms that act now will be better placed to present a credible, investor-ready story.

Five priorities stand out:

- Tighten budget accuracy. Build reporting frameworks that compare budgeted and actual spend at matter, fund, and portfolio level. Variances should be visible, explained, and tracked over time.

- Standardize billing practices. Apply consistent guidelines and approvals across portfolio companies to eliminate fragmentation and demonstrate panel discipline.

- Track disputes and resolutions. Monitor billing queries, write-downs, and challenges with outside counsel. A low rate of disputes signals control and strong relationships.

- Consolidate portfolio data. A single view of legal spend across companies shows leverage with firms and stronger governance to LPs.

- Use year-end as a test run. Treat 2025 year-end reporting as a rehearsal for fundraising. Include variance analysis, compliance checks, and portfolio-level comparisons before investors ask for them.

Firms that adopt these practices now will enter 2026 in a stronger position. Instead of reacting to investor questions, they will be able to demonstrate discipline, transparency, and control over one of their largest operating expenses.

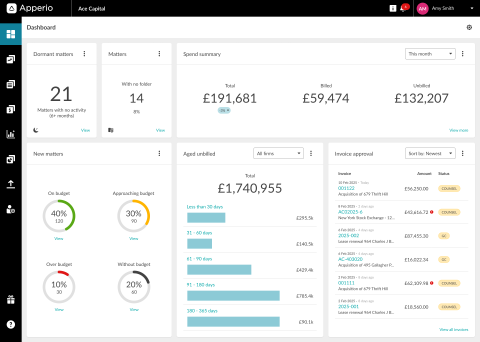

This is where technology makes the difference. Apperio equips Private Equity firms with a continuous feed of auditable data on legal spend, giving legal, finance, and deal teams a shared view of costs before invoices arrive. That visibility strengthens year-end reporting, improves budget accuracy, and builds the evidence base LPs will expect in 2026 fundraising conversations. Combined with PERSUIT’s structured firm engagement and panel management, firms can show both control and consistency. This turns legal spend from a point of investor concern into a marker of operational strength, and of strong fund governance.

See how Apperio helps Private Equity firms strengthen investor reporting. Book a demo.