Scenario planning for 2026: where legal spend fits in

2026 planning will be a test of discipline. Markets are unsettled, deal flow is uneven, and even predictable cost lines are starting to move. Firms are building scenarios, adjusting assumptions, and trying to model for a year that won’t sit still.

But one variable continues to sit outside that process: legal spend.

In many firms, legal already accounts for around 0.6% of revenue. Despite its scale, legal is still treated as a fixed line on the budget rather than a factor to model. Forecasts often rely on historic averages instead of live exposure, and by the time invoices arrive, the numbers have already drifted.

For finance and legal leaders, that lag undermines confidence in their scenarios. For Limited Partners, it signals a weakness in planning discipline.

Legal budgets have always carried a degree of uncertainty, but with markets still uneven and investor scrutiny at its highest in years, firms can’t afford unmodelled costs in their forecasts.

Understanding why legal spend management sits outside scenario planning is the first step to bringing it in…

How unpredictable legal costs undermine confidence in fund-level scenario planning

Legal costs remain one of the hardest areas of fund planning to forecast accurately. The numbers rarely line up, and that uncertainty weakens confidence in even the most carefully built models. Legal spend moves with deal activity, regulatory change and disputes (factors that don’t follow the linear logic of a budget).

Four issues tend to cause the biggest disconnect between plans and reality:

#1. Static budgets fail in variable markets

Scenario models depend on inputs that behave predictably. Legal spend doesn’t. It moves with market volatility and deal activity, rather than the linear rhythm of annual budgets. When that fluctuation isn’t built into models, outcomes appear more stable than they truly are.

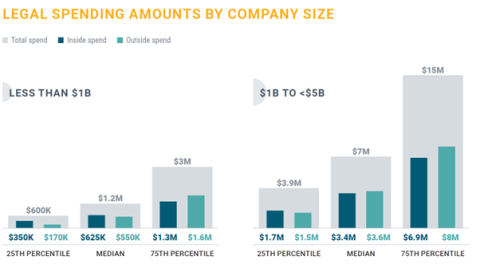

A 2025 benchmarking survey found that the average legal spend shows a general trend from 2021 to 2024, from $3 million to $3.8 million (as shown in the graph below). An increase this large can easily distort IRR assumptions, liquidity planning, and fund-level risk analysis.

The firms ahead of the curve now treat legal costs as a variable, stress-testing exposure against deal flow, regulatory activity and geography.

#2. Timing turns cost control into governance risk

Legal costs are often recorded months after the work begins. When invoices arrive, the real exposure has already moved. That lag turns what should be forward-looking analysis into a historical record.

Progressive firms are closing this lag by integrating live matter data and accruals into rolling forecasts, keeping financial and operational planning in sync as conditions change.

#3. Investors now treat forecast accuracy as a governance metric

Investors are paying closer attention to forecasting precision as a marker of governance maturity. A 2025 Private Equity International report found that 36% of LPs believed their PE allocations underperformed benchmarks, leading to greater scrutiny of how firms plan across all cost lines, including legal.

Predictive capability is now part of how investors assess fund governance.

#4. Visibility has become the new credibility standard

Legal, finance and procurement each hold part of the spend picture. When those views remain separate, scenario testing becomes less reliable. The most mature firms now bring these data sources together — live budgets, matter progress and forecast exposure — into one shared view. With complete visibility, leaders can model both the scale of potential cost changes and the reasons behind them.

Seeing exposure clearly is only the start. The real test is how firms use that visibility to prove control and foresight.

Why scenario planning has become a governance benchmark

Forecasting works in stable conditions. Scenario planning exists for everything else. And right now, stability is in short supply.

Investors are no longer judging firms just on returns. They’re looking at how well leadership teams anticipate change and stay in control when the numbers start to move. Being able to model different outcomes and show how the business would respond, has become a marker of discipline.

And that’s changing expectations for legal and finance teams. Annual budgets and year-end variance reports can’t demonstrate readiness in a market that changes by the month. What’s important right now is showing that the firm can test different conditions, adapt quickly, and keep forecasts credible as scenarios evolve.

| Then: Traditional forecasting | Now: Scenario-planning maturity |

| Annual budgets and historic performance | Continuous, data-driven modelling |

| Judged on year-end accuracy | Judged on speed and adaptability |

| Legal spend seen as a fixed cost | Legal spend modelled like FX or interest-rate risk |

| Investors asked, “Did you stay within budget?” | Investors ask, “How did you prepare for volatility?” |

| Governance shown through financial statements | Governance shown through scenario data and performance outputs |

When firms can explain how legal costs might behave in different conditions, like when activity accelerates, regulations tighten or disputes rise, it shows they’ve thought ahead. That ability to see what’s coming, and plan around it, gives investors confidence that the firm is in control.

How legal spend data strengthens 2026 scenario planning

For many firms, legal spend is still the least modelled line in the forecast. It’s often based on averages or last year’s budget rather than real exposure. That might have worked when markets were steady, but 2026 will demand more precision.

Scenario planning depends on data that updates as fast as conditions change. Finance teams already model variables like FX, debt, or interest rates this way and legal costs now need the same treatment. That’s where the latest spend management tools are starting to make a difference.

Apperio, now part of the PERSUIT platform for outside counsel selection and management, gives firms a continuous view of legal spend across matters, firms, and portfolios. Instead of waiting for invoices, legal and finance teams can see progress and exposure as it happens. It’s this visibility (both historic and live) that turns legal spend management from a fixed assumption into something that can be modelled and managed in near real-time.

1. Historical performance data: understanding the variability of legal spend

Historical insight is the foundation of credible forecasting. Multi-year data allows firms to see where budgets have held steady, where they have deviated, and what has driven that movement.

With Apperio’s structured analytics, legal and finance teams can:

- Identify patterns of variance between budgeted and actual spend across matters, firms, or practice areas.

- Analyze volatility trends linked to market events such as M&A surges, enforcement activity, or new regulation.

- Benchmark forecast accuracy and billing behavior to see where predictability is strongest and weakest.

- Establish confidence ranges around future budgets rather than relying on single-point estimates.

- Provide governance evidence to LPs and boards that budgets are based on measurable behavior, and not assumptions.

This visibility turns historical spend into a forward-looking indicator of risk and control.

2. Live exposure data: keeping forecasts connected to reality

Historical data gives context, but live data gives control. When forecasts rely on quarter-old numbers, they lose relevance fast. Apperio tracks budgets, accruals, and progress as matters evolve, so finance and legal teams always work from the same, current picture.

With that visibility, firms can:

- See active spend before invoices land.

- Review rolling variance and adjust forecasts in real time.

- Maintain one reconciled source of truth across legal, finance, and procurement.

- Provide audit-ready transparency that supports fund reporting.

When combined with PERSUIT’s intelligence on firm selection, scope, and pricing structure, firms can see the link between engagement choices and cost outcomes. Apperio and PURSUIT together provide a connected data foundation that supports evidence-based scenario planning across the full lifecycle of outside counsel management.

This is what’s now defining mature scenario planning. Legal costs no longer sit outside the model; they’re part of the same system of foresight that underpins the rest of the fund.

Integrating legal spend into cross-functional modelling for 2026

Legal spend is one of the last major cost lines to be modelled with real precision. Leading firms are changing that by weaving legal exposure into the same planning frameworks that drive their scenario analysis and fund performance reviews.

1. Connect operational and financial data

Legal costs move with operational events. A delayed closing, a portfolio divestment or a new regulatory issue can all reshape exposure and affect forecasts if they’re not captured early.

By feeding Apperio’s live spend data into the same cycles used for fund modelling and scenario reviews, firms close the lag that has traditionally separated legal from finance. It gives leadership a shared, current view of exposure and keeps every scenario grounded in real data rather than estimates.

2. Stress-test legal exposure alongside other assumptions

Scenario models let teams see how different pressures, like slower exits, rising compliance demands or higher portfolio activity, affect fund performance.

Apperio provides the inputs that make that possible: matter-level budgets and clear patterns of volatility across firms and practice areas. Finance teams can build and adjust scenarios using these insights, testing how legal exposure behaves under different market conditions and turning what was once a fixed line item into a controllable variable.

3. Turn data into fund governance assurance

For investors and boards, integrated scenario planning shows control and foresight. It proves that legal exposure is monitored, modelled and managed continuously, saving reconciliation months later.

Here, PERSUIT adds valuable upstream context: data on firm selection, scope and pricing structures that shape how scenarios begin. Combined with Apperio’s visibility, firms can trace every assumption back to its source and explain how decisions translate into cost outcomes.

When legal data sits inside the same scenario planning models as the rest of the business, it gives firms a clearer picture of resilience. They can see the financial impact of change sooner, adjust with confidence and evidence that discipline to investors.

From visibility to foresight: making scenario planning a year-round discipline

Scenario planning has always been part of good governance, but the best firms now treat it as a live process, not a once-a-year exercise. Markets move quickly, and forecasts built in January can look outdated by March. The firms that stand out are those that keep testing their assumptions and updating their models as new data comes in.

That’s where Apperio adds lasting value. By giving legal and finance teams continuous visibility into spend as it happens, it keeps every scenario grounded in fact. Teams can see live exposure against forecast, spot where costs may run ahead of plan, and adjust before issues escalate.

Paired with PERSUIT’s data on how matters are scoped, priced and staffed, this creates a feedback loop that connects decisions at the start of an engagement with the outcomes at the end. Firms can see how pricing choices, fee structures and firm behavior shape their forecasts and use that insight to plan smarter next time.

For finance leaders, this approach keeps forecasts credible throughout the year.

For legal leaders, it shows clear evidence of control and partnership with the business.

And for investors, it provides confidence that every scenario (and every dollar) is backed by data.

As firms look ahead to 2026, the ability to plan, test and adapt continuously will set the standard. With Apperio and PERSUIT, legal spend becomes more than a cost to monitor. It becomes a source of foresight, value and governance strength.

Learn more about how Apperio and PERSUIT can help strengthen your firm’s planning discipline with complete visibility from instruction to invoice. Book a demo.