Why legal accruals break and how to get them right

Accruals are a normal part of corporate finance. But when it comes to legal spend, they’re anything but straightforward.

Unlike predictable categories such as software or office equipment, legal matters are constantly evolving. Scope shifts. Billing is delayed. And in-house teams are left chasing law firms for estimates that are often inaccurate, late, or both.

The result? Frustration for legal operations, friction with finance, and added pressure on law firms.

That issue is exactly what Chris Perry (VP Sales, Apperio) delved into on a recent episode of the PERSUIT podcast, discussing why legal accruals are so painful, and what forward-thinking teams are doing differently.

📺 Watch the full podcast recording

If you missed the conversation, here are the key insights from the session.⬇

What you'll learn in this blog

- Why legal accruals are uniquely difficult to manage

- How current manual processes and estimates fall short

- The common disconnect between law firms and clients

- How value-based pricing and better data can ease the burden

- What leading legal teams are doing to improve accuracy

Accruals are straightforward until legal spend is added

“Accruals are a very normal part of a business’s financial reporting process,” said Chris. “But they specifically cause a problem when it comes to legal spend.”

Legal matters don’t follow predictable cycles. Billing often lags behind the work, and scope shifts midstream. That creates a mismatch between what has been spent and what has been invoiced, leaving legal and finance teams to fill in the gaps through guesswork.

“Legal spend is a very different beast to most of the categories of spend that businesses have to deal with today,” he added. “And the bigger the company, the more challenging that process can be.”

For legal teams, this often means chasing down estimates from law firms. For finance, it means managing a process that’s more opaque and less reliable than other categories of spend. And for law firms, it introduces pressure to forecast work that hasn’t happened yet.

Here, Chris explains what happens when you forget your lawyers aren’t accountants:

This issue is compounded due to the way accruals are managed.

The manual process burden

Most legal teams still rely on manual processes: emails to law firms, spreadsheets to track responses, and deadline chases near month-end.

“Clients have to request that information manually from law firms,” Chris explained. “Sometimes they’ll ask firms to enter it into a billing system, or they’ll run a regular process to collect it.”

But that’s just one side of the problem. Law firms face their own challenges in responding. Most clients need the data before month-end, which means firms are being asked to project spend that hasn’t happened yet.

“Clients have to pick a date, sometimes like the 15th of the month or maybe the 20th, and they have to ask law firms, ‘What are you going to spend on this matter this month?’” Chris explained.“

And that’s inherently a bit of a difficult question for law firms…

Here’s why law firms pad their estimates and why even accurate guesses can cause problems:

It’s no surprise then that firms are often slow to respond, or that clients end up chasing them for updates they’d rather not be giving.

The limits of spreadsheets, systems, and best intentions

Legal teams have tried everything, from spreadsheets to e-billing tools, to fix the accruals problem. Some build detailed internal processes. Others rely on systems to automate reminders and collect law firm responses. But one issue remains:

These solutions still rely on estimates.

“I think probably in my career I’ve seen the whole gamut of clients trying to solve this,” said Chris Perry. “I’ve seen some really amazing efforts made by legal operations teams… to operationalize how they do accruals reporting and interface with finance.”

The trouble is, every method still asks firms to predict future spend.

“You are relying on your law firms to, one, provide that data in time… and two, on their accuracy,” Chris said. “You are asking them to estimate, or produce a forward-looking estimate.”

That guesswork leads to another issue: over-accruals. Firms don’t want to under-report and create surprises later, so they pad their numbers. The result? Inflated estimates that confuse finance and make legal spend look unreliable.

“What we’ve seen in the data over and over again is that accruals tend to be a little bit overestimated,” Chris noted. “And while that might be really intuitive to people who work with law firms and legal operations, finance teams… that can present some challenges for how they actually run their part of the process.”

AFAs improve accruals

One way to ease the strain on both legal teams and law firms is to rethink how legal work is priced. Accruals are most difficult to manage when billing is based on time. Every month requires another estimate, and every estimate introduces risk.

“Accruals are acutely painful when it comes to hourly work because law firms are having to do that estimate process,” said Chris Perry. “Clients are reliant on the law firm estimate as their guide.”

By contrast, value-based pricing or alternative fee arrangements (AFAs) give both sides a clearer picture of expected costs from the outset. While some adjustment is still needed for scope changes, the process becomes much simpler.

“It gets a lot clearer what costs the business is responsible for or has incurred when you’ve agreed to particular fee arrangements,” Chris explained.

Here’s how value-based pricing can ease the pain of monthly accruals:

Of course, no pricing model eliminates the need for transparency. But the more upfront alignment there is around budget and value, the less back-and-forth there will be later.

A smarter alternative: Continuous visibility of spend

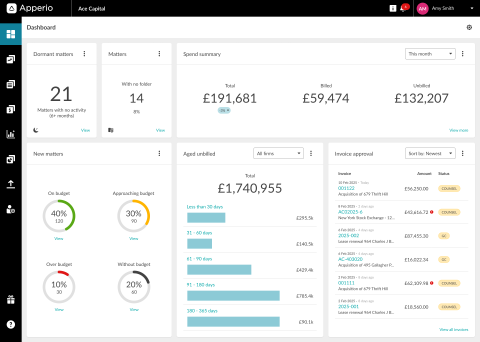

Instead of asking law firms to predict the future, legal teams can work with existing data. That’s where Apperio offers a fundamentally different approach.

“There’s a really interesting approach that you can take to accruals that’s quite different to that estimate-based process that most clients are using now,” said Chris. “What Apperio enables clients and law firms to do is to look at actual unbilled spend.”

Rather than relying on forecasts, legal teams can see what’s been recorded, but not yet invoiced, in the law firm’s timekeeping system. This data gives a far more accurate picture of accrued costs at month-end.

“You can see at the end of the month exactly what costs have been accrued,” Chris explained. “You simplify things dramatically for the law firm… they don’t need to gather data from separate systems and then have some subjective input.”

This method gives legal and finance teams a defensible, reliable source of truth. Finance gets better data, law firms avoid admin overload, and legal ops reduce reconciliation headaches.

“When it comes to the quality of the data you’re providing to finance, it’s much more robust, it’s much more auditable,” Chris said. “You can point to the source of data as being from your law firm systems.”

Small changes make a big difference

Technology can help, but it starts with setting expectations.

“I think the first thing to accept about your accruals process is that it’s virtually impossible for it to be 100% accurate,” said Chris. “The best thing you can do is set really clear expectations… and then agree on what’s most important.”

Here’s the first step to improving your accruals process:

For example:

- Are you trying to stay close to actual spend?

- Or avoid under-accruals at all costs?

Once you align, it’s easier to improve accuracy over time. “Even if you do this in a spreadsheet,” Chris said, “it’s quite straightforward to look at how accurate law firms’ accrual submissions have been versus final payments.”

Bringing clarity to a complex process

Legal accruals don’t have to be painful. With better communication, access to actual spend data, and clearer expectations, legal teams can stop scrambling and start delivering reliable reports that finance trusts.

“Be really clear about what the expectations are,” Chris concluded, “and really why this is a requirement for the legal operations team and the finance team.”

📺 Watch the full episode on YouTube

Want to see how Apperio helps teams track legal spend before the invoice arrives? Book a demo.