Legal forecasting: Why in-house teams are moving beyond static budgets

Many legal teams have made deliberate changes to how they plan and manage spend. In the UK alone, 78% of general counsel are either planning or considering a move away from traditional budgeting models.

Why? Necessity. Legal teams are under growing pressure to provide a forward-looking view of spend that reflects what’s happening in their matters today and not what was predicted six months ago.

Legal work doesn’t follow a fixed course. Scopes develop. Priorities change. Workloads change without warning. Yet many teams are still planning against assumptions made months earlier, without mechanisms to adjust. The result is often the same: overruns, reforecasts, and difficult conversations with finance.

The legal departments functioning at the highest operational level aren’t waiting for surprises. They’re tracking committed spend against progress in real time and updating forecasts as matters unfold. They’re able to project year-end positions with confidence, identify pressure points early, and engage finance proactively.

In the sections that follow, we look at how this approach works in practice and why forward planning is becoming an essential part of legal spend governance.

Why traditional legal spend planning no longer holds up

Legal forecasting can’t be built on static assumptions. Yet many teams are still planning the year ahead based on historical spend, generic rates, or business-as-usual case volumes, rather than the dynamics of live legal work.

➡The problem with fixed legal budgets

Static legal budgets are locked too early and adjusted too late. Once approved, they often serve more as financial guardrails than useful planning tools. As new matters arise or timelines shift, these budgets are rarely recalibrated in real-time, leaving legal teams to defend overruns retrospectively rather than manage them proactively.

This disconnect is especially pronounced when legal is the only function not contributing to quarterly or rolling forecasts. While commercial and operational teams refresh financials routinely, legal often relies on one-off accruals or spreadsheets that quickly lose relevance.

➡Variability is a known quantity, yet it’s not built into planning

Litigation doesn’t follow a calendar. M&A deals don’t wait for the next reporting cycle. Even business-as-usual work can expand beyond original expectations. High-performing legal functions treat variability as a planning constant.

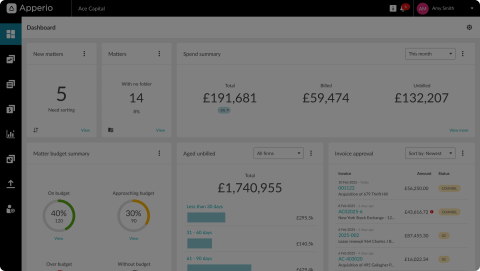

That means linking legal spend planning to in-progress activity. Teams using legal budget software like Apperio continuously track committed spend, surface scope changes early, and feed accurate forecasts into finance systems on a monthly or quarterly basis.

➡Why accuracy builds credibility

Legal forecasting doesn’t need to deliver perfect numbers. But it does need to be defensible. Finance teams aren’t looking for precision to the decimal point. They’re looking for evidence that legal has a handle on current commitments, likely outcomes, and emerging risks.

That’s where many legal teams struggle. A top-line projection, “we think litigation will land around $2 million”, offers little value on its own. What changes the conversation is the supporting view: which matters are still active, how they’re tracking against scope, what’s already billed, and what’s still to come. The confidence comes from the detail, not the headline figure.

Forecasts built on live data and in-progress activity are more credible than those based on prior-year estimates. And when forecasts hold up over time, it changes how legal is perceived as a financially informed business partner.

What legal forecasting looks like in high-performing teams

Advanced forecasting focuses on having the data, structure, and cadence to maintain a live view of committed legal spend. Here’s how top-tier teams are doing it.

1. They structure forecasts using Estimate at Completion (EAC)

Instead of relying on single budget figures, mature teams build forecasts in three layers:

- Invoiced to date: cleared and booked spend

- Committed but unbilled: work in progress plus approved change orders

- Estimated to complete: the remaining cost based on phase progress and resourcing

Apperio supports this model by surfacing all three inputs, without relying on law firm updates or spreadsheet tracking.

2. They use variance decomposition

When forecasts deviate from the plan, the best teams can explain exactly why. That means categorising variance into specific drivers:

- Volume (more work than planned)

- Rate (timekeeper mix changes)

- Timing (phases delayed into a new quarter)

- Scope (formal changes post-instruction)

- Mix (higher-cost lawyers than agreed)

This kind of clarity isn’t possible without visibility. Apperio makes it standard.

3. They trigger reforecasts based on thresholds, rather than reporting cycles

Monthly and quarterly reviews matter, but so do moments when things go off track. Teams using Apperio can define reforecast triggers such as:

- Budget burn rate exceeding X%

- Major scope adjustment approved

- Delay past planned phase-end dates

- Material increase in partner hours

- Contingency drawdown request

When any of these occur, forecasts are updated immediately, instead of being retrofitted later.

4. They manage forecasting error across the portfolio

Accuracy improves when it’s measured. Advanced teams use Apperio to track:

- MAPE (mean absolute percentage error) between original and updated forecasts

- Forecast volatility by work type (litigation, regulatory, M&A, etc.)

- Firm-level forecast reliability over time

This helps surface which firms and matter types introduce the most uncertainty, which is essential for next year’s planning.

5. They build trust by showing supporting details

A forecast without context won’t hold up under financial scrutiny. Teams use Apperio to provide:

- Breakdown by matter and workstream

- Commentary on changes

- Links to billed and unbilled line items

- Visuals showing budget trajectory

This allows firms to walk someone through the logic behind forecasting figures.

6. They separate top-down and bottom-up views

Legal leaders align portfolio-level forecasting with individual matter-level views. That means:

- Top-down: portfolio allocations tied to business priorities

- Bottom-up: data from Apperio, showing what’s committed and expected per matter

Discrepancies are reviewed, explained, and resolved immediately as they crop up.

7. They centralise contingency management

Rather than padding every matter, advanced teams calculate tail risk based on historic overruns and manage contingency centrally. It’s released only when justified.

Apperio supports this by making overruns visible early and traceable.

8. They use structured commentary

To avoid long explanations or back-and-forth, some teams use a simple structure for every reforecast:

- Driver of change

- Recommended action

- Risk to portfolio

- Proposed trade-off

Apperio supports this structure by anchoring commentary directly to matter data.

9. They link forecast reliability to pricing model maturity

Forecast accuracy improves with better intake. PERSUIT plays a key role here by helping legal teams:

- Define scope clearly

- Select firms with proven delivery records

- Use pricing structures with fewer unknowns (e.g. AFAs, fixed-fee stage gates)

That reduces the margin of error from the start and improves trust in the forecast downstream.

10. They track firm predictability over time

With data from Apperio and matter intake from PERSUIT, teams can benchmark:

- Forecast accuracy by firm

- Rate drift

- Timekeeper mix variance

- Scope change frequency

Firms that perform well earn more work. Firms that don’t are asked to explain.

Legal forecasting: 5 questions to ask yourself

Use this as a quick diagnostic for your current forecasting discipline:

- Can you produce an updated Estimate at Completion (EAC) for your top 10 matters within 24 hours?

If not, your forecasting process likely depends too heavily on manual input or firm updates. - Do you know which firms are most likely to deliver on budget?

Track forecast error, timekeeper mix, and scope change frequency over time. - Are forecasts updated only by calendar, or by triggers too?

Define reforecast triggers such as budget overrun thresholds or phase delays. - Can finance see how your forecast is built?

Supporting commentary, billed/unbilled detail, and matter breakdowns are essential for credibility. - Is pricing discipline feeding into forecast quality?

PERSUIT helps shape predictable engagements. Apperio validates how they’re playing out in practice.

Build a forecasting discipline that lasts

For many legal teams, budgeting is familiar. Forecasting is where the real challenge lies. It requires more than annual approvals. It demands a consistent ability to project where legal spend is heading, explain why, and adjust in time to act.

The teams doing this well have moved beyond intuition and end-of-quarter reconciliations. They’ve established forecasting as a shared discipline, underpinned by timely data, clear assumptions, and structured reforecasting rules. They treat predictability as a performance indicator, rather than a nice-to-have.

Apperio provides the visibility and structure to support that discipline. By tracking billed, unbilled, and committed spend in real time, it gives legal and finance a shared view of what’s happening and what’s likely next. PERSUIT complements this by improving the reliability of forecast inputs, with better scoping, pricing, and firm selection from the outset.

Together, they give legal teams the tools to plan more effectively, respond with confidence, and hold the line on financial credibility, all without waiting for the invoice.

Ready to strengthen your legal forecasting discipline? Get in touch for a demo.

Source: https://blog.zavenlegal.com/2024/10/22/uk-legal-departments-pivot-to-tech-forward-budgeting-for-2025/