3 legal spend processes mid-sized PE firms use to control legal costs

Previous research shows private capital firms are feeling pressured by increased scrutiny of all costs – and 77% say legal spend on individual transactions is a material concern.

Yet, a new analysis of legal spending in private equity shows mid-sized PE firms have an edge over larger competitors in effectively managing legal expenses.

While larger PE firms enjoy some benefits of scale in negotiating legal prices, those advantages are lost in the net total. This is because they tend to have a more hands-off approach to managing legal expenses than their smaller rivals.

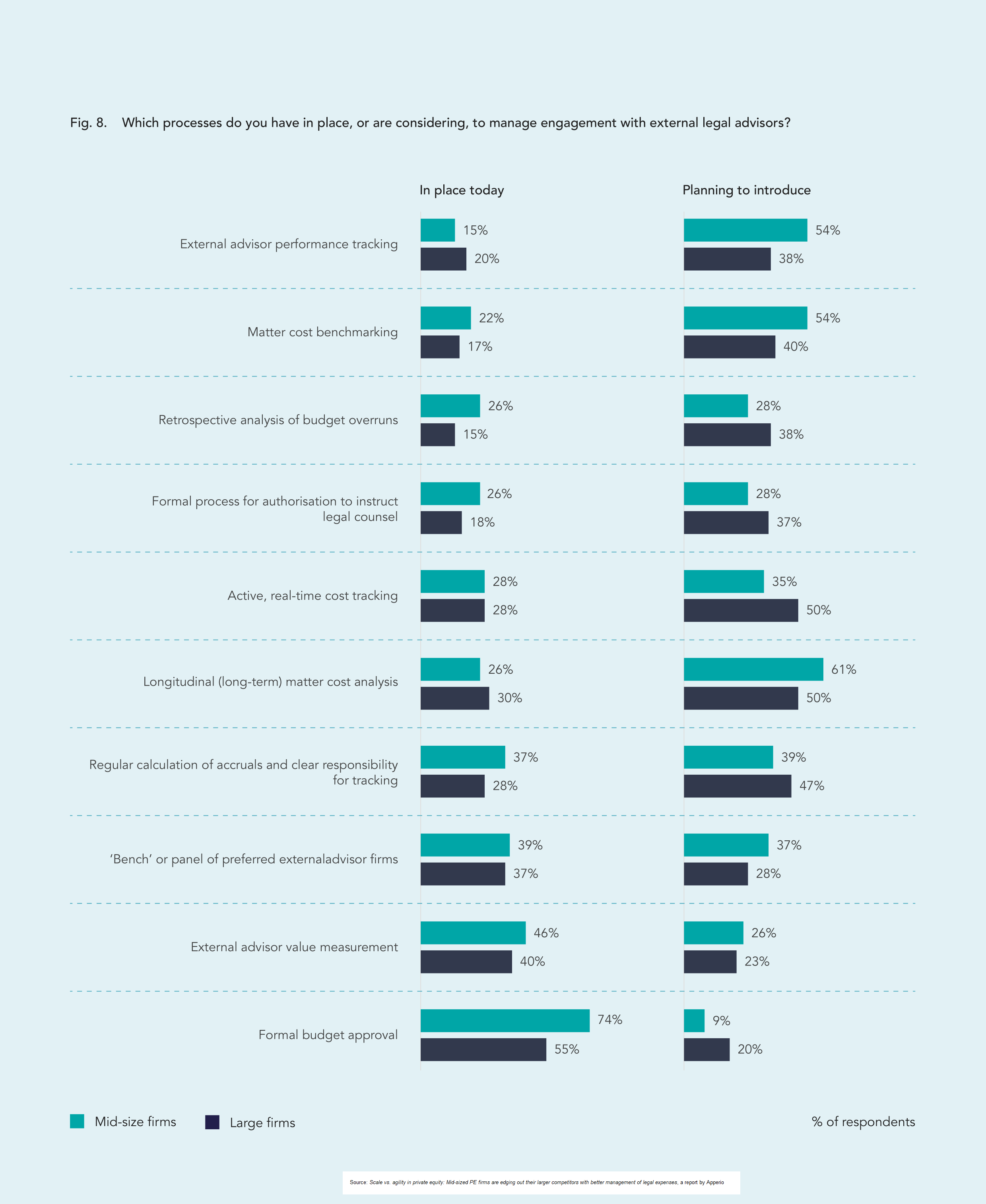

The difference in approach is most pronounced in legal spend process maturity. When asked about ten conventional processes for managing legal engagements, mid-sized firms edged out large firms in seven out of the ten named processes.

Below are three examples of processes mid-sized PE firms are more likely to have implemented to actively manage legal costs.

1. Require a formal budget approval process for new matters.

Nearly three-quarters (74%) of mid-sized PE firms require a formal budget approval process for new legal matters, compared to just 55% of large PE firms.

2. Actively track their law firm accruals.

Some 37% of mid-sized firms say they perform a “regular calculation of accruals” compared to just 28% of large firms.

3. Perform retrospective analysis of cost overruns.

About one quarter (26%) of mid-size PE firms say they perform a retrospective analysis to understand why a particular matter went over budget, while just 15% of large PE firms are inclined to do the same.

Legal spend optimization is a priority

On the upside, PE firms of all sizes have recognized spiraling legal costs as an issue – and have plans to address it. Some 72% of mid-sized PE firms and 77% of large PE firms say legal spend optimization is a priority for their organization in 2021.

Read the complete analysis: Scale vs. agility in private equity: Mid-sized PE firms are edging out their larger competitors with better management of legal expenses.

* * *

If you enjoyed this post, you might also like:

The 5 ways private equity handles higher-than-expected legal bills