What the 2026 legal market data says about value, pricing, and client expectations

The 2026 State of the US Legal Market report shows general counsel spend anticipation dropping to pandemic-era lows. Budgets have flatlined, even as legal work has gotten more complex and more expensive to handle.

Meanwhile, one thing has barely budged: how most of that work gets billed. Nearly 90% of legal spend still runs through hourly billing. That's held steady even as firms pour money into AI and efficiency tools designed to cut the time it takes to deliver work. Here's the problem though—the report makes it clear that speed and saved hours aren't enough to justify higher rates on their own.

What clients actually want is coming into sharper focus: predictability, alignment, and a clear line of sight between legal spend and business priorities.

This blog digs into what the latest market data tells us about value, pricing, and client expectations. And why visibility during delivery is becoming non-negotiable as scrutiny keeps ramping up.

Key takeaways from the 2026 US legal market data

The 2026 State of the US Legal Market report points to growing pressure on legal teams, even as demand remains high:

- Legal demand grew 1.9% in 2025 – one of the best years since the Global Financial Crisis

- Worked rates jumped more than 7% – well ahead of inflation

- Law firm profitability rose by double digits – extending a multi-year streak of strong performance

- General counsel spend anticipation fell to 2020 levels – signaling much tighter budgets ahead

- Nearly 90% of legal spend is still billed hourly – despite massive investment in AI and efficiency tools

- Clients spent less per legal hour in 2025 than in 2024 – thanks to actively moving work to lower-cost providers

- Technology spend grew 10.5% year over year – with AI now standard across large firms

- Around one in four buyers say they've never seen a firm deliver excellent value at a premium price

This is why scrutiny of external legal spend is increasing, why buyer confidence is weakening, and why visibility during delivery has become essential to how leading teams manage cost, value, and firm relationships.

Why strong legal demand is masking falling buyer confidence and tightening GC budgets

Legal demand stayed high through 2025, largely because regulatory and economic uncertainty kept legal teams busy. But that demand hasn’t eased pressure on in-house teams managing external spend. If anything, it’s cranked up.

You can see it in buyer sentiment.

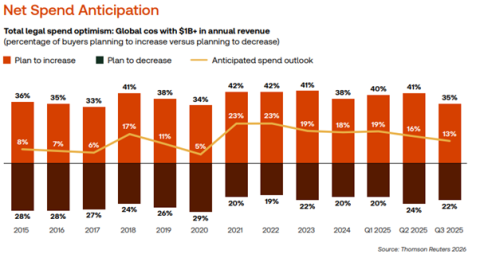

- Net Spend Anticipation dropped throughout 2025, getting close to pandemic lows

- More general counsel now expect spend to flatline or fall, even though the work is just as complex and time-sensitive as ever

-

Legal teams are burning more hours explaining and justifying external costs internally

Instead of cutting back on volume, clients are changing where the work goes. The report calls this “mobile demand.” Work is moving away from the most expensive firms and toward lower-cost providers. That reallocation has had a big impact. It let clients spend less per legal hour in 2025 than they did in 2024, even as rates kept climbing.

That behavior says less about demand and more about discipline. Legal teams still need the capacity and expertise, but there's far less tolerance for uncertainty when costs are stacking up. Decisions about staffing, which firm gets the work, and how matters progress now carry serious weight.

That’s why the market feels tighter, even though activity hasn’t slowed. As confidence weakens, legal operations teams are zeroing in on predictability, visibility during delivery, and being able to explain external spend in terms the business actually understands.

How worked rates growing 7%+ are increasing scrutiny on external legal spend

Worked rates rose by more than 7% in 2025. For teams operating on flat budgets, that increase is felt right away. There’s just no room to absorb extra review cycles, duplicated effort, or senior time that doesn’t actually change the outcome.

You can see this in how legal spend gets managed day to day:

- Rate increases are now getting weighed against who's doing the work and how it's tracking

- Senior time is under the microscope, especially when it keeps showing up on routine tasks

- Teams want to see costs building while work's in motion—not weeks later when the invoice drops

The data also shows that tolerance for surprises is shrinking fast. As rates climb, unplanned cost overruns become nearly impossible to defend internally. Legal teams want assurance that spend will stay close to what was agreed when the work kicked off.

The result? Cost conversations are happening sooner and more frequently. Oversight isn't something you save for the end anymore. It's becoming how teams maintain control while work's actually happening.

Why hourly billing and AI-driven efficiency are colliding with client expectations

One thing jumps out in the data. Nearly 90% of legal spend is still billed hourly, even as firms invest heavily in tools designed to speed up delivery.

That creates a real headache for teams managing external spend. When work takes less time, but rates keep rising, the cost becomes harder to explain. Legal teams end up defending outcomes that look more efficient, yet still come in higher than expected.

This is exactly why efficiency gains aren’t landing as value for clients.

What firms talk about: speed, productivity, and hours saved.

What clients actually care about:

- Does the staffing match what we agreed on?

- Is the work progressing the way it should?

- Are costs tracking to what we discussed as delivery unfolds?

It is telling that more than 80% of corporate legal leaders don’t require firms to use AI. Faster delivery alone doesn’t create confidence.

The defensive pricing conversation

You can see this play out in pricing conversations. The report notes that firm leaders increasingly feel defensive when explaining value—even when work gets delivered faster than before. From the client side, speed carries almost no weight if it doesn't come with clarity around cost and delivery.

Hourly billing concentrates most of these conversations to the end of the process, when invoices land and your options have already narrowed. That is why legal teams are pushing for visibility earlier. They want to see how work is staffed, how effort gets applied, and how spend is building while there is still time to do something about it.

The value translation problem

Without that visibility, efficiency gains are hard to translate into value. As the report notes, around a quarter of buyers say they’ve never experienced a firm delivering excellent value at a premium price. In that environment, higher rates become nearly impossible to justify, no matter how efficiently the work gets produced.

📕Further reading: Law firm AI efficiency: Who captures the savings?

Why clients are reallocating work and why visibility during delivery is a must-have

Legal teams are choosing firms that stay aligned as work progresses, rather than the ones that show up with explanations once costs are already locked in.

That choice reflects what's happening inside legal departments. Flat budgets leave almost no margin for error. When spend starts to move off course, the impact is immediate and hard to absorb. Trust gets built through consistent delivery, not through reputation or looking back at what went wrong.

That consistency hinges on two things:

- Clear agreement upfront on scope, pricing, and expectations

- Live visibility once work is underway

Without both, even the most carefully structured engagements start to unravel. Staffing choices, review cycles, scope changes—they all surface late, when your options have narrowed and the conversations get a lot harder.

This is why oversight is moving earlier. Legal teams want to see how work is unfolding while there is still time to adjust course. They want clarity on who's handling what, how effort is getting applied, and whether spend is tracking against what was agreed at the start.

PERSUIT sets the foundation by helping legal teams nail down scope, pricing, and engagement expectations before work begins. Apperio then shows how that work gets staffed and paced as it's actually happening—giving you visibility into costs as they build, not weeks later at billing.

When this structure is in place, conversations change. Adjustments happen mid-flight. Cost conversations stay anchored in shared understanding. Firm relationships get stronger because alignment holds throughout, and legal teams can manage spend with confidence instead of constantly firefighting.

Staying in control as scrutiny increases

Legal teams are operating with tighter legal budgets, rising rates, and more questions from the business than ever before. The data makes one thing crystal clear: managing external spend through invoices alone means you're reacting late, with almost no room to shape what happens next.

Leading teams are taking a different approach. They set clearer expectations upfront and stay close to how work progresses. That gives them the chance to catch issues earlier, course-correct while there’s still time, and keep firm conversations productive.

Apperio and PERSUIT support this way of working by connecting upfront scoping and pricing with live visibility into how spend accumulates. That helps legal teams stay in control, maintain alignment with firms, and explain legal spend across the business with actual confidence.

Want to see how it works? Book a demo.