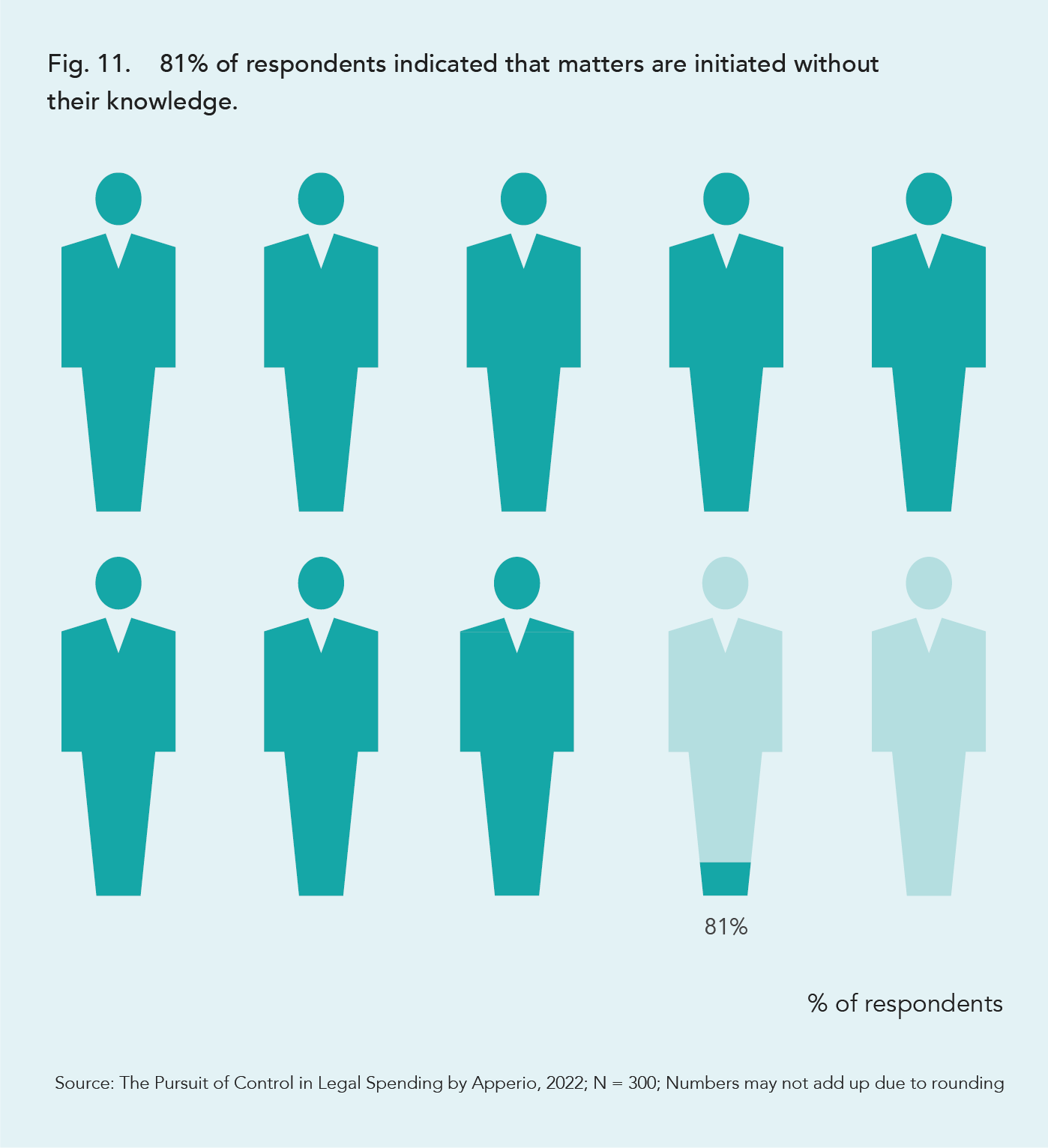

Forecasting legal expenses: 81% of in-house lawyers for investment firms say some matters are initiated without their knowledge

If forecasting legal expenses is sometimes unpredictable for investment firms, part of the problem can be traced to the organizational structure. Deal teams want to move quickly on competitive deals and for that reason, are empowered to initiate matters with law firms directly.

This often happens outside the purview of the in-house legal team. For example, a recent survey we commissioned found that 81% of respondents indicated that matters are initiated without their knowledge some of the time. Further, nearly half say this happens “always” (22%) or “often” (24%).

Some respondents – 61 in total – described how they learn about these new matters in open-ended comments. Below is a representative sample.

- “By investigating thoroughly between breaks and working hours.” ~ legal partner, private equity

- “By invoice within the company,” ~ chief counsel, venture capital

- “By setting a committee to make a deep investigation.” ~ senior legal counsel, private equity

- “From Human Resources.” ~ general counsel, private equity

- “It comes through administration.” ~ chief counsel, private equity

- “Normally through emails to inform of the work required.” ~ chief counsel, venture capital

- “The CEO.” ~ general counsel, private equity

- “The department is informed by a third-party agency.” ~ legal partner, private equity

- “The legal department learns of these matters from an inside source.” ~ associate general counsel, private equity

- “They are notified as soon as they happen.” ~ senior legal counsel, private equity

- “Through meetings and discussions with senior management.” ~ associate general counsel, private equity

- “Via conference meeting weekly.” ~ chief legal officer, private equity

- “We are notified through other senior executives.” ~ chief legal officer, private equity

- “We receive an email from the investors.” ~ chief legal officer, private equity

- “When we get the invoices.” ~ chief legal officer, private equity

Some of these answers are truly remarkable and underscore the nearly impossible position in which some lawyers find themselves. Even the best lawyers in the world can’t accurately forecast legal expenses if the first time they learn of a matter is when they receive an invoice from a law firm for a deal that’s already closed.

There are two fundamental ways to solve this business problem:

- Centralize all legal work through the legal department; or

- Implement a legal spend management software product like Apperio – to automate the process of notifying the legal department and provide them with visibility into new matters and costs.

“That’s one thing I remember that stood out in the demo – the fact that Apperio sent us an alert as soon as a file was opened at the law firm,” said Sarah Gormley in a customer story.

Sarah is the Head of Legal Operations for Phoenix Group, the largest long-term savings and retirement business in the UK. “[Apperio] is such a fantastic tool for us, just being able to have that control to make sure the legal department is always aware of what's happening.”

Some private equity firms are already doing so. As one principal legal officer for a private equity firm wrote in a survey comment, their legal department finds out about new matters “through our software.”

* * *

The complete survey report is freely available for download here: The pursuit of control in legal spending.